Table of Contents

Bitcoin Surges to New Heights Amid Institutional Demand

Bitcoin has soared beyond the US$110,000 (approximately AU$170,000) mark, achieving a new all-time high. With a remarkable weekly gain of 6% and a staggering 26% rise over the past month, the cryptocurrency’s bullish trend is undeniably strong, especially as the pressures of former U.S. tariff threats diminish.

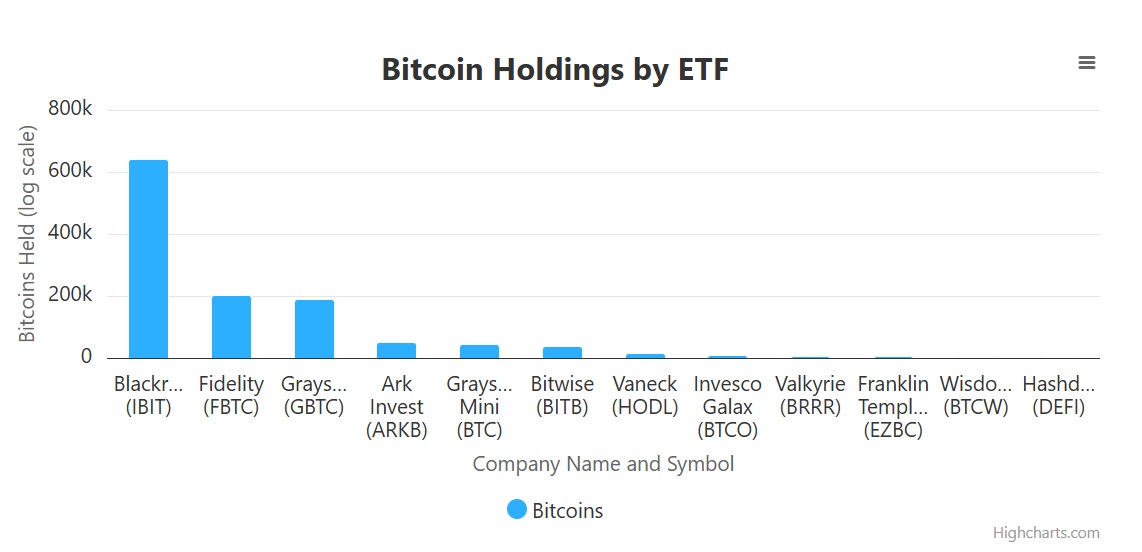

This recent surge is not merely a result of retail investors experiencing fear of missing out (FOMO); rather, it highlights significant participation from institutional investors. Over just three trading days, U.S. spot Bitcoin exchange-traded funds (ETFs) have collectively added US$1.04 billion (about AU$1.61 billion) to their assets, accounting for 5.68% of the total Bitcoin supply. BlackRock’s IBIT ETF leads this charge with a substantial holding of 638,824 Bitcoin.

BlackRock is leading US ETFs holding the most BTC, source: Highcharts/BiTBO

The Changing Landscape of Bitcoin Investors

The latest Bitcoin bull market is being heavily influenced by institutional investors, as highlighted by analysts from 10X Research. This new wave of investment is markedly different from previous cycles characterised by retail speculation. Historically, Bitcoin has seen various kinds of promoters—from cypherpunks to hedge fund leaders—emerging during its distinct bull phases. Now, notable figures like BlackRock’s Larry Fink and Michael Saylor are at the forefront, and even past sceptics like Jamie Dimon from JPMorgan are beginning to show more favourable attitudes towards Bitcoin.

Despite the potential for retail investor excitement, significant selling is primarily attributed to long-term holders relinquishing their assets. An example of this institutional shift is Texas’s recently passed Bitcoin reserve bill, highlighting the growing acknowledgment and integration of Bitcoin into more traditional financial frameworks.

Institutional Support Over Retail FOMO

According to 10X Research, the current price increases can be viewed as "calculated and disciplined portfolio rotation" rather than panic selling. This rotation signifies a trend of Bitcoin accumulating in the hands of high-net-worth individuals, hedge funds, and corporate treasuries, including titans like MicroStrategy. The quiet nature of this accumulation keeps whale deposits low while stabilising market volatility.

However, analysts are cautious about future price movements. They warn of the risk that could arise once long-term holders cease their selling activities. If that occurs, the previously observed patterns of demand decline could lead to earlier adopters becoming reluctant holders once again, mirroring market dips experienced in March 2024 and January 2025.

In Conclusion

Bitcoin’s recent spike over the US$110,000 threshold showcases a significant shift in market dynamics, driven largely by institutional investment rather than retail FOMO. As more large investors accumulate Bitcoin, the market may maintain its stability in the short term, but attention must be paid to the behaviour of long-term holders, which could dictate future trends. Market participants and analysts alike are keenly observing these developments as figures in the financial world continue to adapt to the presence of Bitcoin in their portfolios.

[Learn more about the evolving crypto landscape and institutional adoption by following our reports on trends and market insights.]