Table of Contents

Ripple Eyes Circle: Acquisition Rumours in the Crypto Space

Ripple, the prominent San Francisco-based fintech company, is reportedly keen on acquiring the stablecoin issuer Circle. Initially, Ripple put forth a bid of US$5 billion (approximately AU$7.75 billion), but this offer was reportedly declined. Following that, speculation arose about a second offer moving up to US$20 billion (around AU$31 billion).

Circle recently caught attention by filing for an Initial Public Offering (IPO) on the New York Stock Exchange (NYSE). However, according to a Fortune report, the company’s future may not lie in going public. Instead, they may consider selling to either Ripple or cryptocurrency exchange Coinbase, while seeking at least US$5 billion for the deal.

Despite the ongoing speculation, Circle publicly asserts that they remain “not for sale,” and their outlook for a successful IPO continues unaltered.

Circle: In Demand Yet Not For Sale?

Sources familiar with the situation suggest that Circle would prefer a deal with Coinbase, highlighting an eagerness to sell if approached. One anonymous source noted:

If Coinbase wanted to buy them, Circle would sell in a heartbeat.

The ambiguity surrounding the negotiations indicates a dynamic environment, with a source stating that “things change week by week,” highlighting a constantly evolving situation.

Nonetheless, Circle maintains its position that it is not currently seeking to sell, indicating a strong commitment to their IPO ambitions.

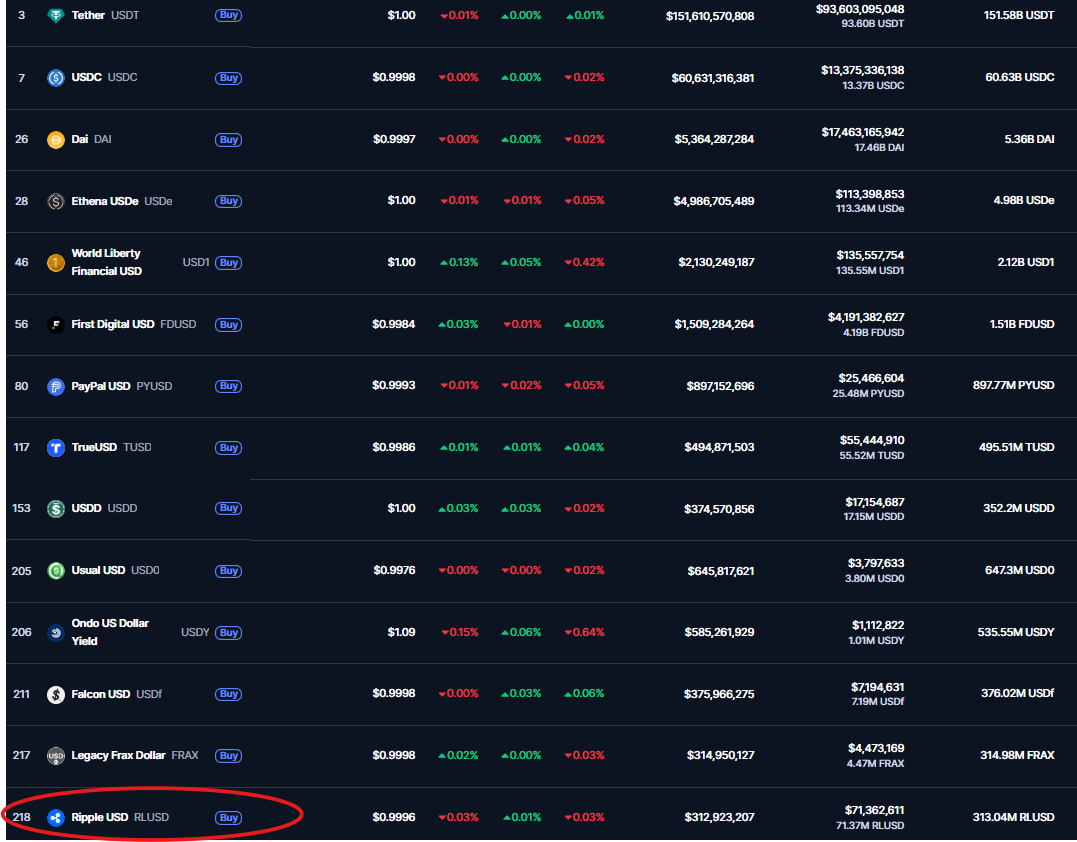

Circle’s stablecoin, USDC, stands as the second-largest in the market, boasting a market capitalisation of US$60 billion (around AU$93 billion) and a significant 24-hour trading volume of US$13 billion (approx. AU$8.4 billion). For reference, Tether (USDT) leads the market with a cap of US$305 billion (roughly AU$472 billion) and daily trading of US$93 billion (nearly AU$144 billion).

In contrast, Ripple’s stablecoin, RLUSD, sits on the lower end, with a capitalisation of just US$312 million (about AU$483 million) and a daily volume of US$313 million (around AU$485 million).

Source: CoinMarketCap

The Implications of a Ripple-Circle Deal

Should Ripple successfully acquire Circle, analysts predict significant advantages for Ripple, particularly for its cryptocurrency, XRP. Observers, including All Things XRP on Crypto Twitter, noted that Ripple aims to “dominate payments, own stablecoin rails, and position XRP as the default bridge currency for transactions.”

Ripple has recently bolstered its operations by acquiring prime-brokerage Hidden Road for US$1.25 billion (approximately AU$1.93 billion) and has launched a cross-border payments platform in the United Arab Emirates in conjunction with Zand Bank and Mamo.

The potential acquisition of Circle could have bullish implications not only for Ripple but also for the broader cryptocurrency sector. Both Coinbase and Circle, co-founders of the Centre Consortium that introduced USDC back in 2018, have navigated a complex partnership. Following the consortium’s conclusion in 2023, Coinbase retained an equity stake in Circle, while Circle assumed full governance of USDC.

In summary, while Circle is adamant about its long-term goals and IPO plans, the whispering winds of potential acquisition by Ripple or Coinbase have stirred interest in the market. With XRP standing to gain from such a merge, the attention shifts to whether either company can ultimately strike a deal.

For Further Reading

- Queensland Man Loses 25 Bitcoin, Waterfront Mansion, and Mercedes in AFP Asset Forfeiture