Table of Contents

The State of Bitcoin Ownership in the US: Key Insights from Recent Research

According to a study conducted by River, a notable 40% of all Bitcoin is owned by American citizens. This significant portion escalates further when discussing institutional investment, where a staggering 94.8% of corporate Bitcoin holdings belong to American firms. The United States also commands 65.3% of Bitcoin holdings by nation-states.

Bitcoin Ownership Across Demographics

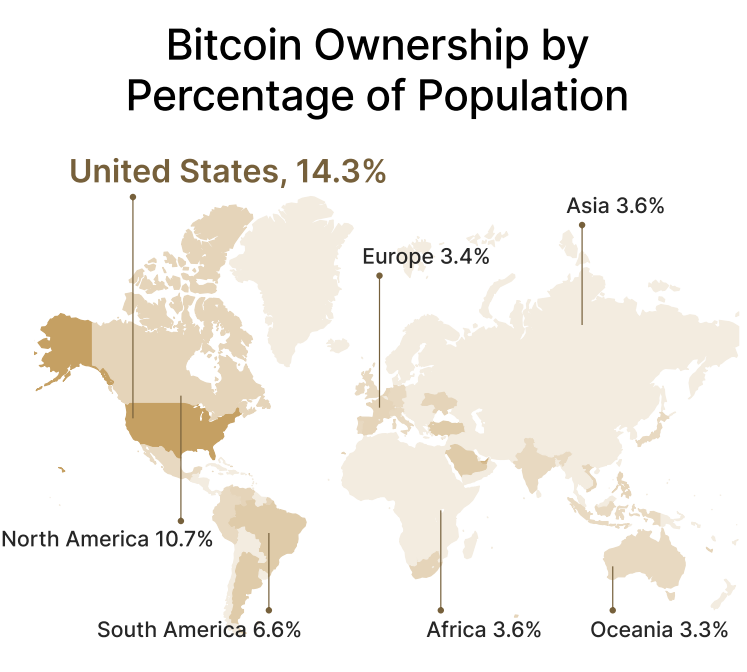

The report highlights that Bitcoin’s appeal transcends racial, political, and socio-economic lines. Specifically, 14.3% of the American population owns Bitcoin, which is markedly higher than the 3.5% ownership rate observed in other global regions. When compared to Europe, Asia, and Oceania, where ownership hovers around 3.4% to 3.6%, the US stands out as a leader in Bitcoin adoption.

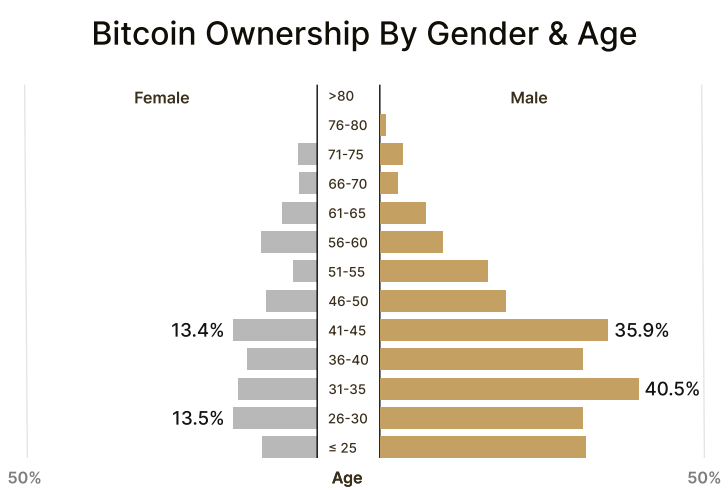

Importantly, Bitcoin ownership is not limited to tech enthusiasts; it spans a broad range of demographics. However, a significant gender gap persists, with Bitcoin being predominantly owned by younger males.

"Bitcoin is accessible to everyone; you don’t need to be wealthy or an accredited investor to participate in its potential. However, Bitcoin is more commonly owned by younger generations and males." — River

Institutional Adoption and Public Policy

The report further notes that 32 American public companies, representing a total market capitalisation of approximately US$1.26 trillion, hold Bitcoin as part of their treasury assets. Overall, public companies globally, including non-US firms, collectively own around 795,971 BTC, valued at US$84.9 billion.

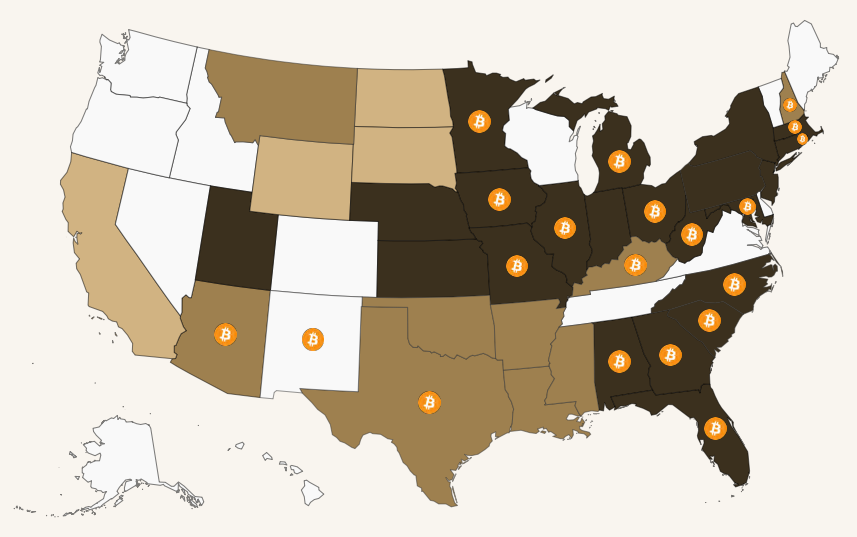

Moreover, 36 US states are actively pursuing pro-Bitcoin initiatives. Recently, Arizona and New Hampshire made headlines for enacting Bitcoin reserve legislation, showcasing the push towards institutional and governmental acceptance of the cryptocurrency.

In Arizona, the governor initially rejected a proposal but later accepted a more refined bill that permits the state to acquire unclaimed digital assets instead of engaging taxpayer funds for cryptocurrency purchases. New Hampshire has distinguished itself as the first state to formally create a Bitcoin reserve.

Conclusion

The River report elucidates the United States’ dominant position in Bitcoin ownership and adoption. With a substantial portion of the population, and indeed corporations, actively participating in Bitcoin, the US seems geared for continued leadership in the cryptocurrency space. The findings underscore Bitcoin’s unique capacity as an inclusive asset class and indicate a potential trend towards wider acceptance and utilisation across various states and sectors in America.