Table of Contents

Maple Finance Expands with syrupUSD on Solana

Maple Finance is making strides in the decentralized finance (DeFi) arena by extending its reach from Ethereum to the Solana blockchain. This move involves deploying its yield-bearing stablecoin, syrupUSD, on Solana platforms Kamino and Orca, alongside an initial liquidity boost of US$30 million (approximately AU$46 million).

The expansion aims to establish substantial liquidity in the Solana ecosystem, boosting lending, trading, and collateral activities. This transition is made possible by Chainlink’s Cross-Chain Interoperability Protocol (CCIP), which was activated on Solana’s mainnet in May. CCIP facilitates seamless communication between the Ethereum and Solana virtual machines, thus streamlining the cross-chain deployment for Maple.

Strategic Play in a Competitive Market

Sid Powell, CEO and co-founder of Maple, expressed that this move is part of a broader strategy to tap into Solana’s rapid environment, which can accommodate increased user engagement ranging from institutional investors to sophisticated DeFi users. "Expanding to Solana unlocks a high-speed, high-capacity environment where Maple’s products can reach a broader class of users," he noted.

As of this expansion, Maple Finance—valued at approximately US$1.3 billion (AU$2 billion)—finds itself in direct competition with prominent Solana lending protocols such as margin.fi, Rain.fi, and Port Finance.

While Solana is on a growth trajectory, it is still overshadowed by Ethereum, which maintains a total value locked (TVL) of nearly US$60 billion (AU$92 billion). However, this figure represents a 43% decline from Ethereum’s peak in 2021, according to data from DefiLlama.

Source: DefiLlama.

Growth Through Tokenisation

Maple’s success this year is largely tied to its aggressive strategy regarding the tokenisation of private credit, positioning itself as the third-largest player in the real-world asset (RWA) sector. The platform currently manages over US$3 billion (AU$4.61 billion) in loans across Ethereum, Base, and now Solana.

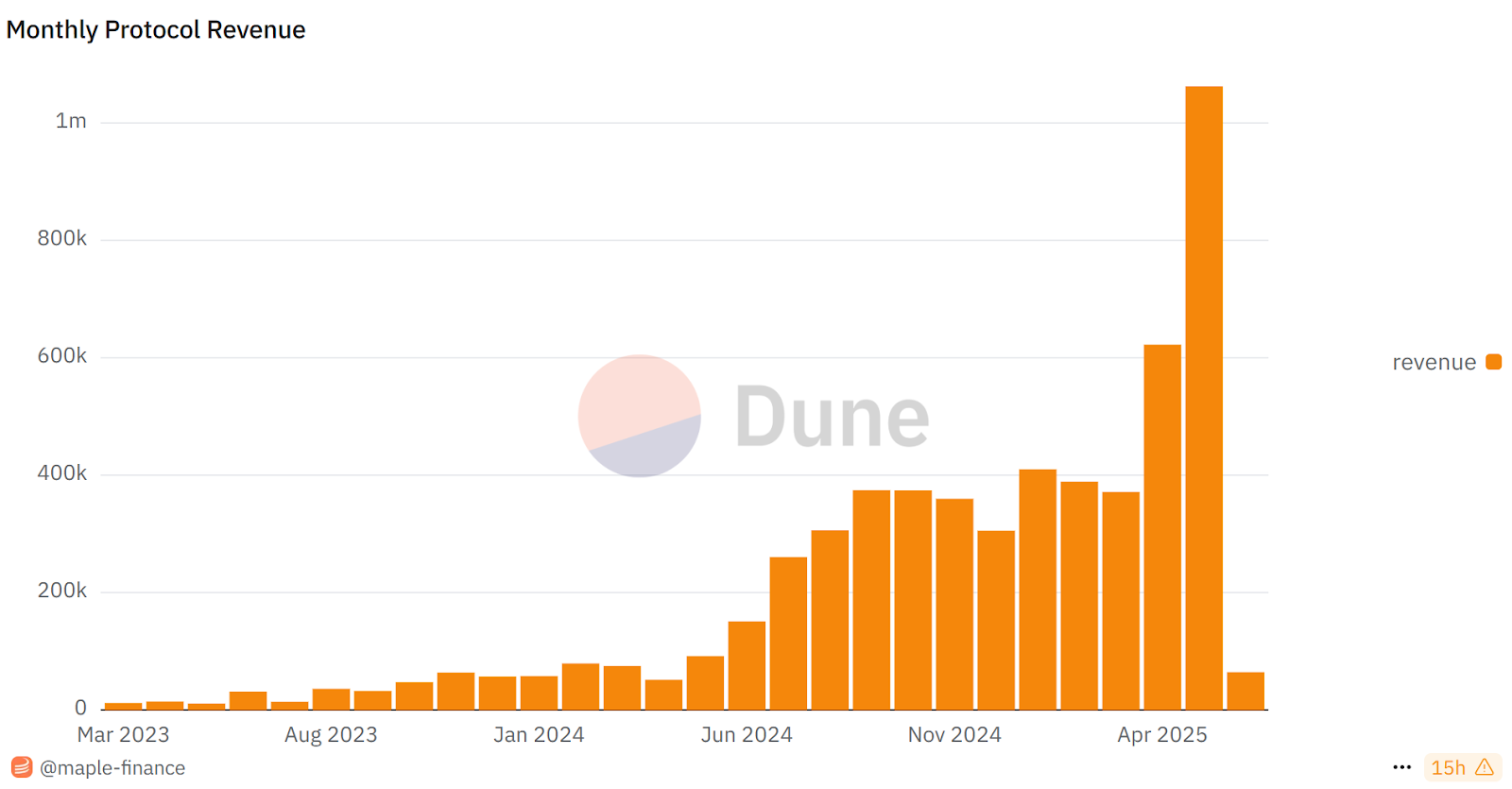

Source: Dune Analytics.

This growth is also reflected in the assets under management (AUM), which have surged from approximately US$470 million (AU$723 million) at the beginning of 2025 to nearly US$1.9 billion (AU$2.9 billion) today, solidifying Maple’s rapid rise in the DeFi sector.

In summary, Maple Finance’s strategic move to leverage Solana’s fast-paced environment through the introduction of syrupUSD represents a significant step in its quest to broaden its influence within the DeFi landscape. With a robust liquidity foundation and a focus on private credit tokenisation, Maple is poised to compete effectively with other lending protocols while continuing its trajectory of impressive growth.