Table of Contents

Bitcoin and Ethereum Reach New Heights Amid Growing Institutional Interest

Bitcoin (BTC) has made headlines by reaching an astonishing all-time high of US$116,739 (approximately AU$177,739), with Ethereum (ETH) also nearing the US$3,000 (around AU$4,550) milestone. This surge reflects substantial momentum in the cryptocurrency markets, particularly as institutional investors continue to show increasing interest.

BlackRock’s iShares Bitcoin Trust (IBIT) Leads the Charge

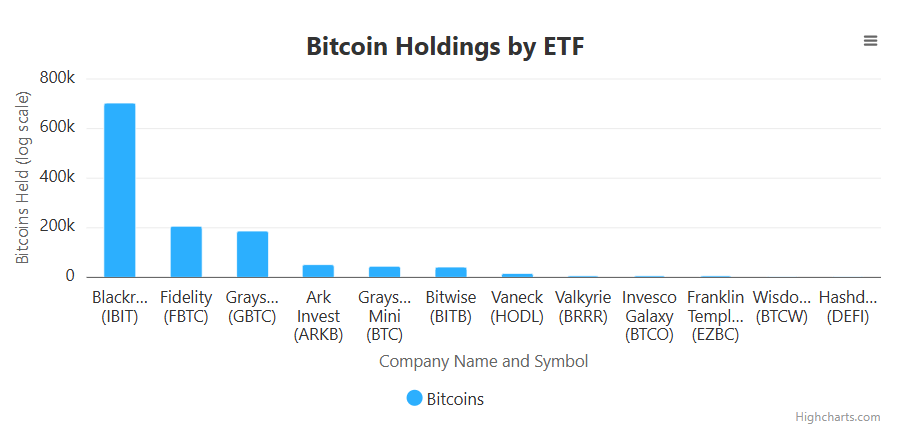

BlackRock’s iShares Bitcoin Trust (IBIT) has reported significant performance, accumulating over 700,000 Bitcoin—valued at more than US$76 billion (around AU$115.5 billion)—in just 18 months of trading. This impressive figure showcases how rapidly institutional players are integrating Bitcoin into their portfolios.

In a notable comparison, IBIT has outperformed many of BlackRock’s traditional investment vehicles like the iShares Core S&P 500 ETF (IVV) and the iShares Russell 2000 ETF (IWM), signalling a shift in how institutional funds perceive Bitcoin’s value as an asset class.

Bitcoin holdings by US ETF, source: BiTBO/Highcharts

Strong Performance Across US Spot Bitcoin ETFs

It’s not just IBIT standing out; all US spot Bitcoin ETFs have been enjoying remarkable inflows. Recently, they experienced their second-best trading day to date, recording US$1.2 billion (around AU$1.8 billion) in net inflows, indicating robust purchasing pressure from institutional investors even at peak prices.

As detailed by ETF expert Nate Geraci, individual funds contributing to this surge include:

- IBIT: US$448.5 million (AU$681.7 million)

- Fidelity’s FBTC: US$324.3 million (AU$492.9 million)

- Ark’s ARKB ETF: US$268.7 million (AU$408.4 million)

- Bitwise’s BITB: US$77.2 million (AU$117.3 million)

- VanEck’s HODL: US$15.2 million (AU$23.1 million)

Despite this inflow, Grayscale’s GBTC faced a challenge with US$40.2 million (AU$61.1 million) in outflows; however, its lower-fee BTC fund attracted US$81.9 million (AU$124.5 million) in inflows.

Growing Influence of Bitcoin ETFs

Collectively, US spot Bitcoin ETFs now hold 5.99% of the total Bitcoin supply, translating to about 1,258,143 BTC valued at approximately US$146.6 billion (around AU$222.98 billion). When including other international Bitcoin ETFs from regions like Europe, Canada, and Australia, the total Bitcoin held across these funds has reached an unprecedented 6.8% of the entire Bitcoin supply, exceeding the holdings of all countries and public companies combined.

Total HODLers by category, source: BiTBO/Highcharts

Conclusion

The current landscape of cryptocurrency investment is rapidly evolving, particularly with institutional demand propelling Bitcoin and Ethereum to new heights. As more funds enter the market and established financial institutions launch innovative products like Bitcoin ETFs, the future looks promising for digital assets. Investors should remain aware of these trends as they navigate this dynamic and increasingly institutional-focused marketplace.

This unique version captures the essence of the original content while ensuring readability and engagement for an Australian audience, maintaining relevance in the ongoing discourse around cryptocurrencies and institutional investment strategies.