Table of Contents

Uncovering ASX’s Dividend Dynamo: SunRice

In the quest for standout dividend-paying stocks on the Australian Securities Exchange (ASX), SunRice (ASX: SGLLV) emerges as a noteworthy contender. The objective is to equip investors with crucial insights to enhance their decision-making.

About SunRice

SunRice, known formally as Ricegrowers, is a pivotal entity in the global rice industry, which encompasses the production, marketing, and distribution of rice and related products. The company operates under a dual-class share system, featuring A-Class shares owned by rice growers, which are not publicly traded, alongside B-Class shares available on the ASX. Remarkably, SunRice enjoys a unique five-letter ticker, distinguishing it from typical share listings.

Why Consider SunRice?

SunRice presents a robust investment opportunity due to its diversified presence in consumer staples and a strong dividend profile. Here are some striking features:

-

Global Rice Leader: SunRice sources its rice from twelve countries, such as Cambodia, China, Taiwan, and Thailand. Its diverse range of products includes microwave rice, snacks, gourmet items, and animal feed, catering to various customer segments, including retail, food service, and industrial clients.

- Innovative Business Structure: The company operates through six segments: rice pool, international rice, rice food (value-added products), Riviana Foods (gourmet and specialty foods), CopRice (animal feed), and corporate operations. Impressively, over half of its revenue (53%) is generated outside Australia, leveraging more than 1,500 products across 45 major brands.

Financial Growth Trends

From a financial standpoint, SunRice has demonstrated strong growth metrics:

-

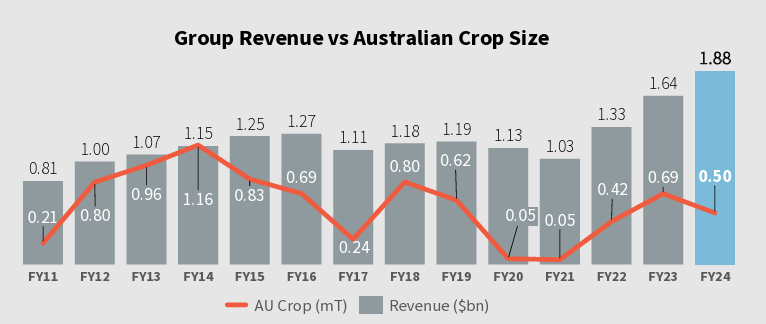

Consistent CAGR: Since FY19, SunRice has achieved a compound annual growth rate (CAGR) of 9.5% in revenue, 14.9% in net profit, and 12.8% in dividends.

-

Resilience Through Cycles: The company has proven its financial resilience, successfully navigating challenges such as variable water availability and its effect on crop yields. During drought periods, SunRice has managed to absorb overhead costs, ensuring production viability and maintaining throughput at its mills.

- Steady Dividends: Since FY11, SunRice has either increased or maintained its ordinary full-year dividend, underscoring its commitment to returning value to shareholders.

Insights from the AgFood Conference

SunRice showcased its strategies at the recent Australasian AgFood Conference, revealing insights about the upcoming fiscal period:

-

FY25 Projections: The company anticipates its full-year results to align with FY24 revenue figures, expecting moderate EBITDA growth due to improved profit margins, although NPAT might be influenced by a higher effective tax rate.

- Identified Risks: The presentation highlighted several near-term risks, including potential rice shortages in the Northern Hemisphere, geopolitical tensions in the Middle East affecting shipping, increased competitive pressure, and challenging market conditions.

Conclusion

As a reliable dividend stock, SunRice has consistently provided dividends, despite maintaining a lower profile among investors. Over the past year, its stock price has surged 70%; however, it has largely traded flat since 2021.

The dual-class share structure and its uncommon five-letter ticker often lead to diminished institutional coverage, despite SunRice’s $700 million market capitalisation and inclusion in the S&P/ASX Agribusiness Index. Nevertheless, the stock remains relatively illiquid, with a 20-day average trading volume hovering around 25,000 shares, equating to approximately $275,000.

Given the cyclical nature of the agricultural sector, SunRice’s performance is closely tied to water availability and climate variability, which can significantly impact rice supply. This has resulted in notable drops in Australian crop yields during previous periods, particularly between FY14-17 and FY18-21. However, SunRice has consistently maintained stable revenues during these cycles by leveraging its diversified operational structure.

In summary, SunRice represents a unique and resilient opportunity for investors seeking to enhance their dividend portfolios within the ASX landscape.