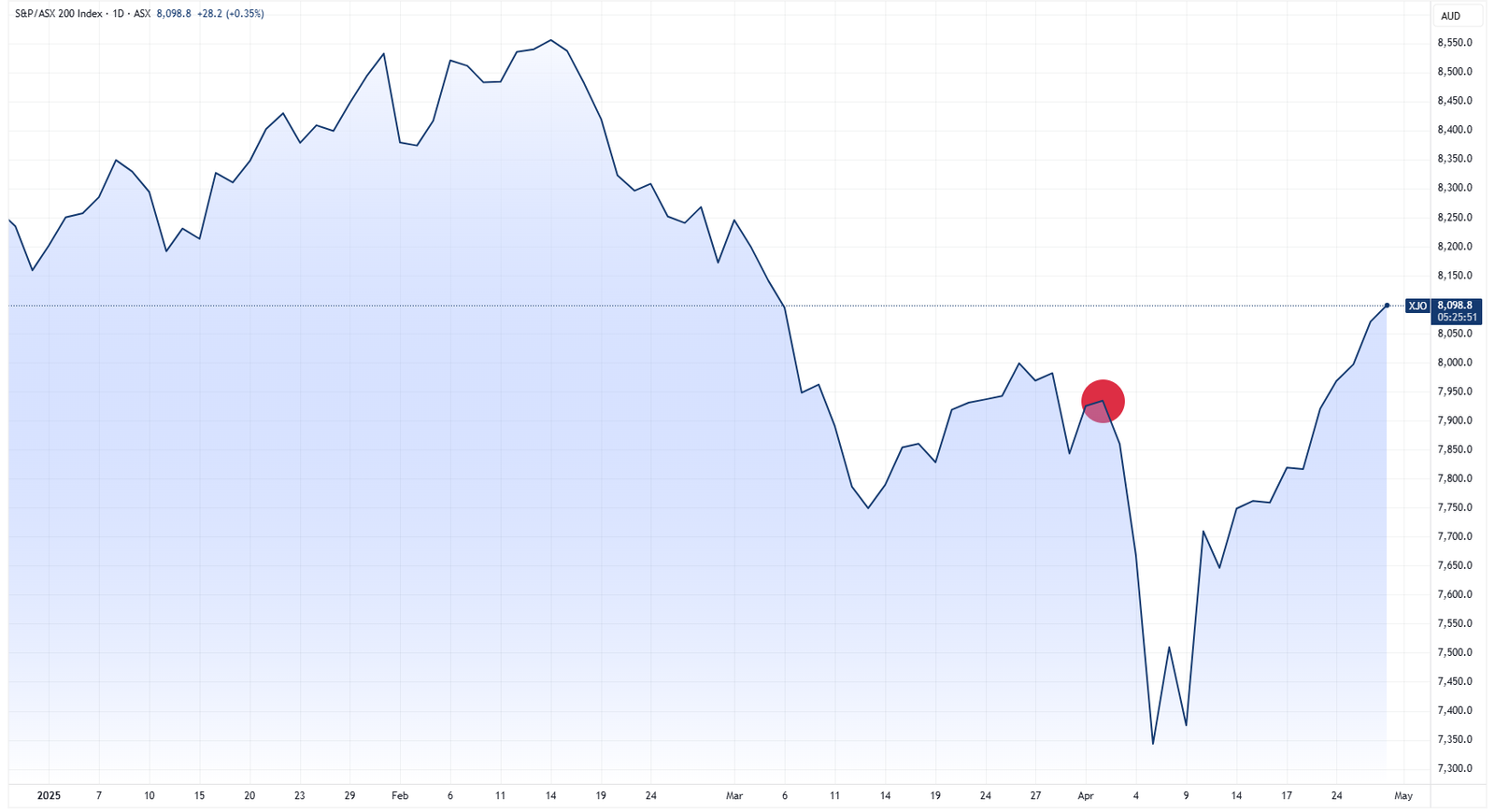

The S&P/ASX 200 index has marked a notable recovery, surpassing levels seen before President Trump’s "Liberation Day" announcement on April 2, 2025, which rattled global markets. Currently, the ASX 200 is trading 2% higher than the levels of April 2 and has risen over 10% since its low on April 7. In contrast, major indices across the US, Europe, and Asia remain below their pre-tariff levels. Analysts caution, however, that such gains may be tenuous, considering economic uncertainties and possible downgrades in earnings forecasts.

Why the ASX is Outperforming

UBS analysts have identified several structural advantages that contribute to what they term "Aussie exceptionalism":

- Low Tariff Risk: Australia lacks a trade surplus with the US, which diminishes the risk of targeted tariffs.

- Flexible Exports: Its exports, primarily agricultural, can be redirected to different markets more easily than manufactured goods.

- Domestic Focus: Many ASX 200 firms primarily generate revenue locally, insulating them from global trade disruptions.

These dynamics have attracted global investors seeking stability, bolstering capital inflows into Australia. Nevertheless, UBS warns the current rally might be detached from fundamental economic realities, with GDP growth forecasts for 2025 and 2026 being revised downwards, indicating softer corporate earnings ahead.

Earnings Clouds on the Horizon

Despite the ASX 200’s upswing, analysts predict a wave of disappointing corporate results. A UBS report indicates diminishing earnings momentum, leading analysts to reconsider near-term profit projections as expectations shift towards 2026. Increased uncertainty surrounding US trade policies has raised the risk premium investors expect, potentially impacting stock valuations negatively.

Reflecting this caution, UBS has revised its year-end target for the ASX 200 down from 8,850 to 8,150 (currently at 8,100). The investment bank recommends reducing portfolio risk, advising investors to favour sectors like technology, media, and telecoms (TMT) which have a domestic focus while adopting an underweight stance on energy and financials due to less favourable earnings outlooks.

Sector Shifts and Strategic Picks

In navigating the uncertain economic environment, UBS has updated its sector recommendations:

- Healthcare: Upgraded to neutral from underweight, as it offers attractive valuations with a price-to-earnings ratio of 1.4x, below the historical average of 1.6x, and potential earnings downgrades nearing a bottom for large-cap stocks.

- Industrials: Downgraded to neutral from overweight due to vulnerability to a slowing US economy. Investors are encouraged to prefer domestically focused companies to reduce risk.

- Insurance: Remains overweight, although signs indicate peak conditions for Australian insurers. The sector presents strong pricing power and appealing valuations.

- TMT: Maintained as overweight, given Australian firms in this sector typically outperform during economic downturns.

- Banks and Energy: Continues underweight. While banks have benefited from safe-haven flows, impending interest rate cuts may put pressure on earnings. The energy sector faces challenges from declining prices, with UBS suggesting it is not "cheap enough" given the macroeconomic backdrop.

Additionally, UBS has introduced three new stocks to its preferred list, alongside established names like BHP, QBE Insurance, and Telstra:

- Seven Group: Favours from robust activity within the mining and infrastructure sectors.

- Technology One: A domestically focused technology firm projected to achieve 20% annual profit growth over the next five years.

- Steadfast: An insurance broker known for its defensive characteristics and robust ties to resilient small businesses.

Investor Takeaways

The ASX has demonstrated resilience in the face of global challenges, supported by its inherent structural advantages. However, anticipated softening in economic growth and potential earnings downgrades could cool the ongoing rally. Opportunities lie within domestically focused sectors like insurance and TMT, but caution is prudent in energy and banking, where earnings momentum appears to be slowing. With Australia’s quarterly reporting season on the horizon, the market’s direction will largely depend on whether companies can deliver on their guidance or face a sobering reality.