Table of Contents

Australian Real Estate Stocks and Market Trends

In recent broker reports, there’s been a noticeable shift in focus towards Australian Securities Exchange (ASX) listed real estate stocks. Analysts, including those from Citi, speculate that the Reserve Bank of Australia (RBA) might have to implement substantial interest rate cuts to prevent a recession, with predictions of reductions reaching 100 basis points by year’s end. While a recession can negatively impact all sectors, historically, real estate valuations (particularly Real Estate Investment Trusts) tend to improve in a declining interest rate environment.

Analytical Approach

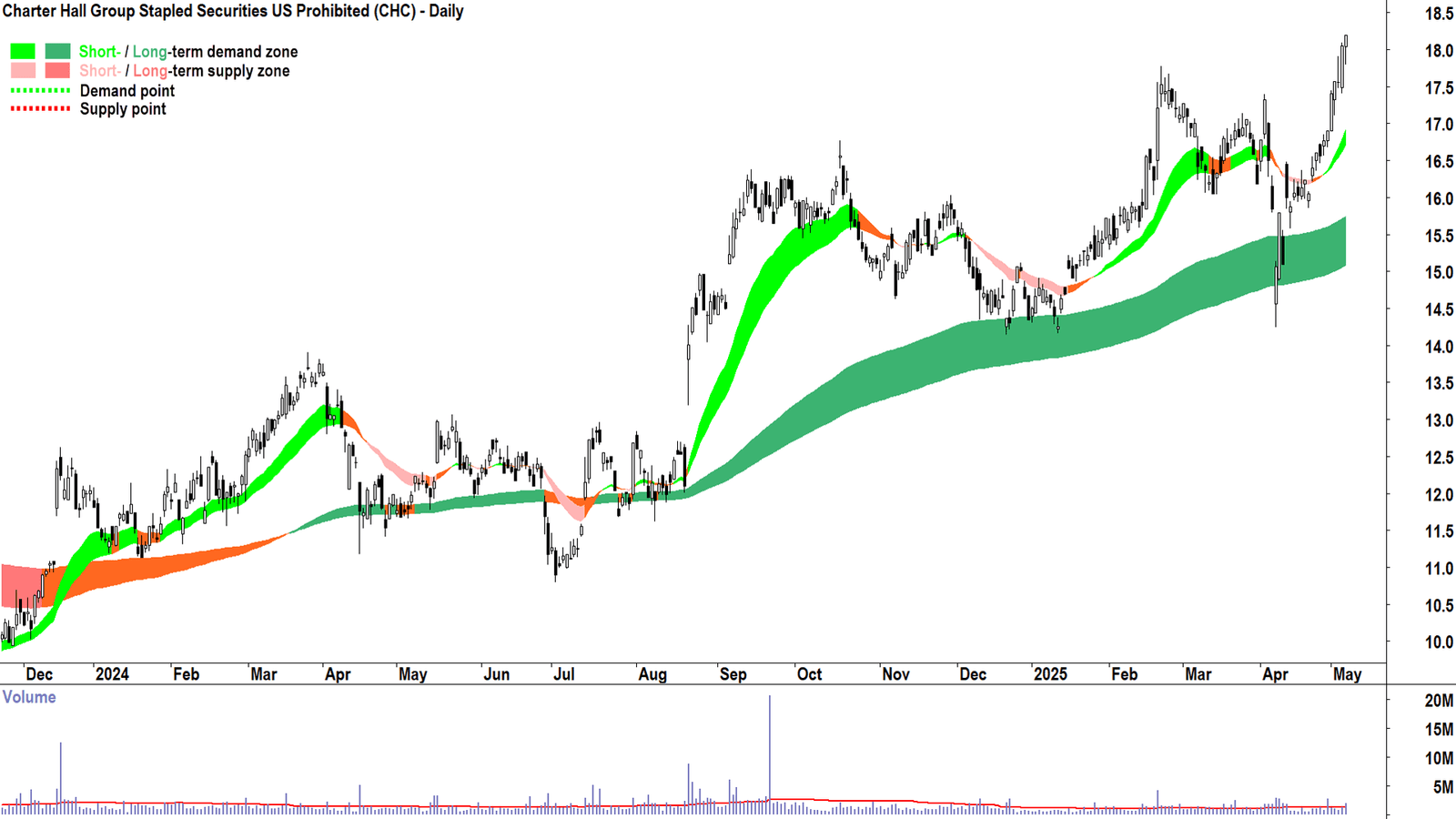

Despite the economic theories at play, the primary emphasis here is on price action and trends rather than fundamentals. A recent scan highlights an increasing number of real estate stocks appearing in uptrend lists, including the likes of Charter Hall Group (CHC), GPT Group (GPT), Management Group (MGR), and more.

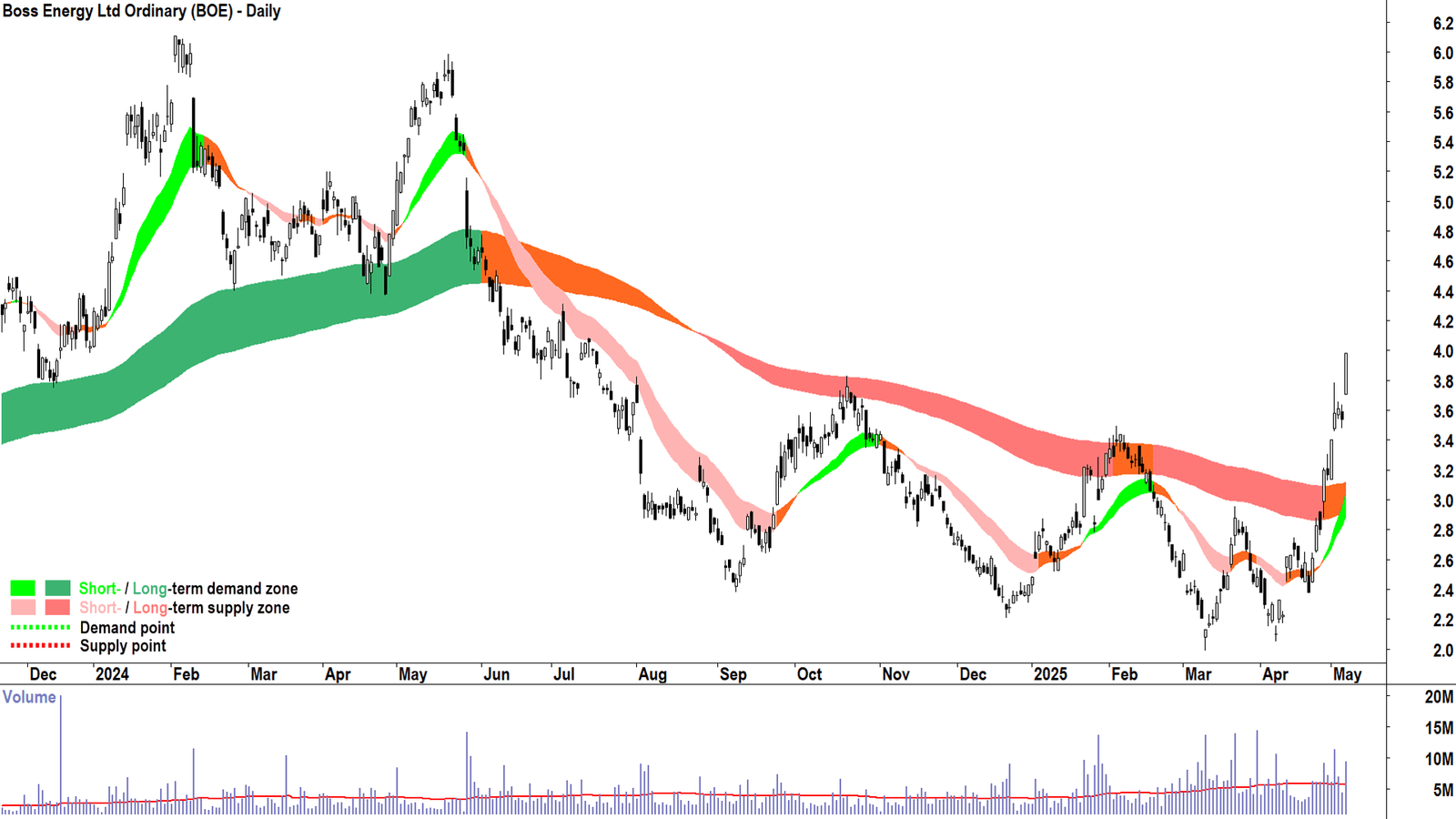

One notable stock is Boss Energy (BOE), which has shown significant momentum recently, first appearing in the "Feature Chart" section on May 1st and again due to a strong performance in the latest trading sessions, buoyed by rising uranium prices.

Welcome to the ChartWatch series, where we explore transaction trends on the ASX through technical analysis. This aims to help identify both uptrends and downtrends based on observed data, assisting investors in making informed decisions.

Practical Application of Trends

Investors can leverage this data to identify strong uptrends, potentially capitalising on these stocks while seeking to avoid or short-sell those in downtrends. However, utilization of this data is ultimately at the discretion of the investor.

It’s essential to note that stocks may reappear in these lists as they continue to meet the established criteria, while those that slip from the lists will not trigger alerts, necessitating ongoing personal research regarding changes in trend status.

Uptrends Scan List

| Company | Code | Last Price | 1mo % | 1yr % |

|---|---|---|---|---|

| Ausgold | AUC | $0.610 | +15.1% | +117.9% |

| Boss Energy | BOE | $3.98 | +77.7% | -25.0% |

| Charter Hall Group | CHC | $18.20 | +10.3% | +54.9% |

| GPT Group | GPT | $4.80 | +7.9% | +15.1% |

| Mirvac Group | MGR | $2.33 | +9.4% | +13.1% |

| Stockland | SGP | $5.66 | +13.0% | +28.3% |

| Technology One | TNE | $31.55 | +12.8% | +95.7% |

The aforementioned companies exemplify the strength and demand in the current market, with Boss Energy leading in recent performance metrics.

Featured Stocks

Today’s standout stocks from the Uptrends list exhibiting robust upward demand include:

- Ausgold (ASX: AUC)

- Boss Energy (ASX: BOE)

- Charter Hall Group (ASX: CHC)

- GPT Group (ASX: GPT)

Charts

Downtrends Scan List

| Company | Code | Last Price | 1mo % | 1yr % |

|---|---|---|---|---|

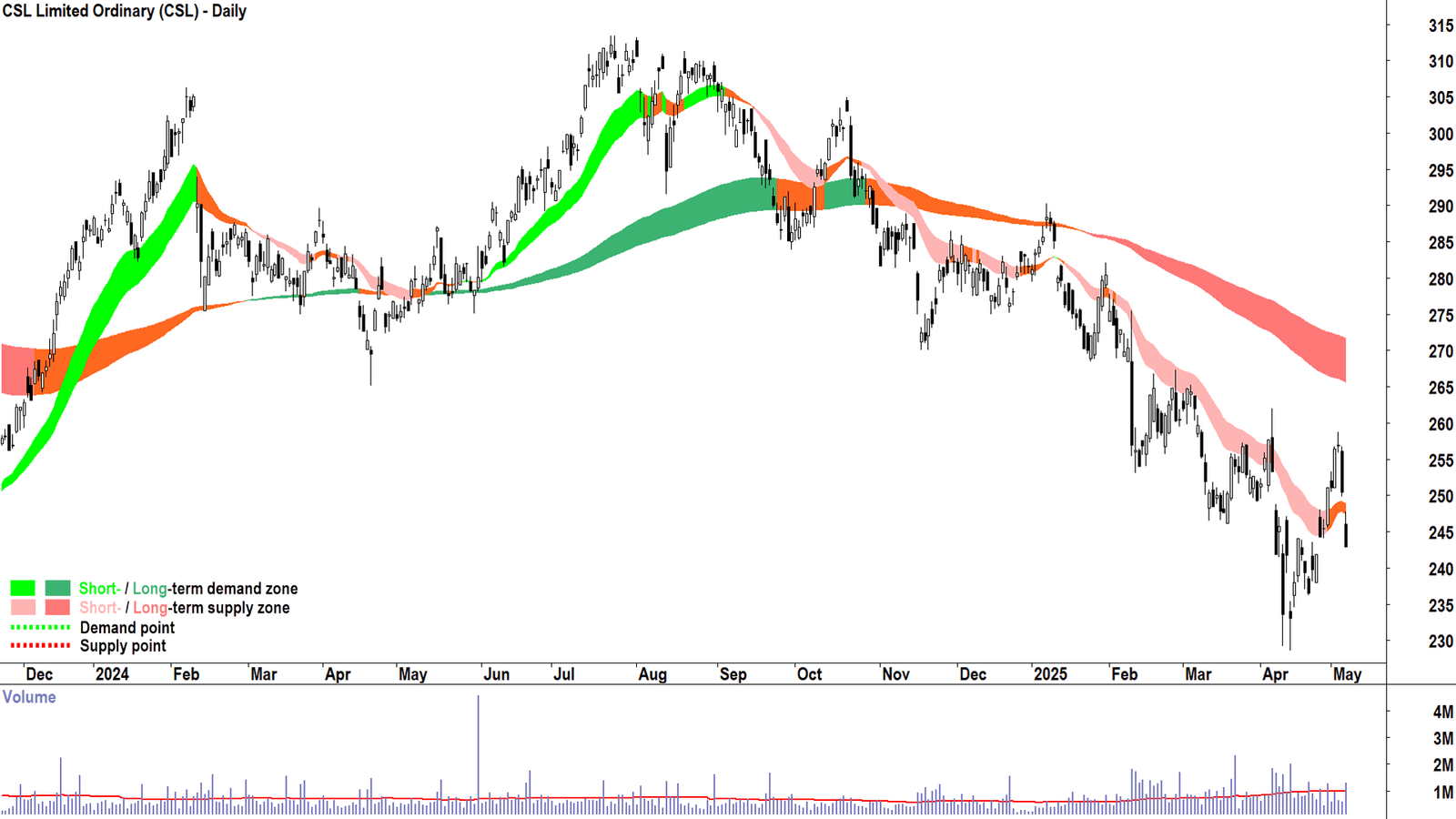

| CSL | CSL | $242.98 | -5.7% | -11.9% |

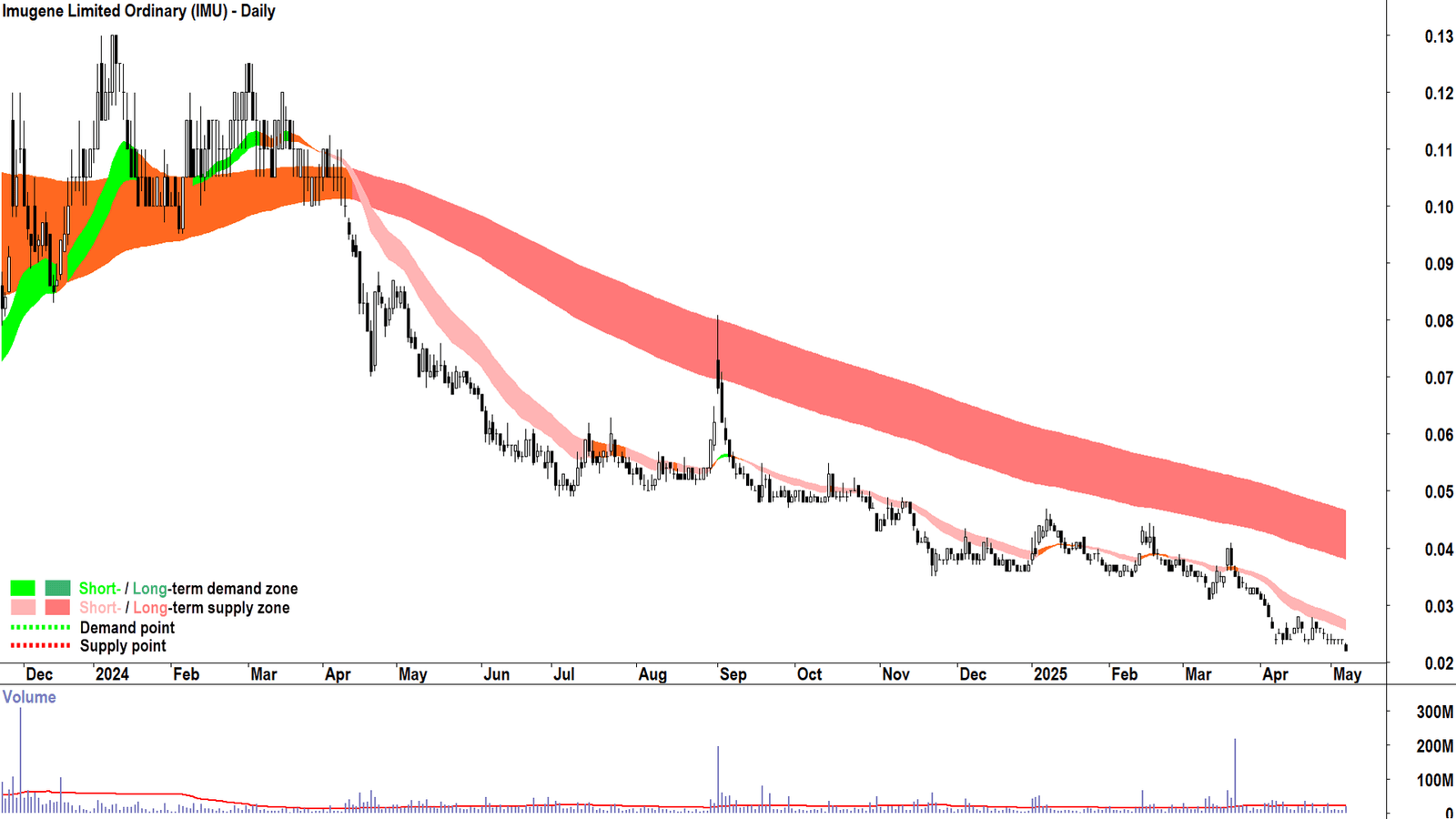

| Imugene | IMU | $0.022 | -21.4% | -73.2% |

| Propel Funeral Partners | PFP | $5.08 | -3.6% | -5.6% |

| The Star Entertainment Group | SGR | $0.105 | -32.3% | -80.9% |

Featured stocks demonstrating strong signs of excess supply from today’s downtrend list include:

- CSL (ASX: CSL)

- Imugene (ASX: IMU)

- Propel Funeral Partners (ASX: PFP)

Charts

Conclusion

The ASX market is witnessing substantial activity along key sectors, especially in real estate, as shifting sentiments around interest rates influence investor behaviour. It’s imperative for traders to stay updated on these trends while conducting thorough research for informed decision-making.