Table of Contents

Celebrating One Year of ChartWatch ASX Scans 🎂🥳

This week marks the first anniversary of ChartWatch ASX Scans. To commemorate this milestone, we’ve taken a look back at the most significant highlights and lowlights of the past year’s analyses.

Focus on the Continuation Setup

Today, we shine a spotlight on the continuation setup, one of the two primary setups identified in ChartWatch. Tomorrow, we will explore the second setup, the turnaround setup.

As the name implies, a continuation setup emerges within an ongoing trend. This can either be bullish or bearish. A "long" continuation setup occurs in a stable upwards trend, while a "short" continuation setup plays out in a well-established downwards trend. Notably, the term "long" refers to the expected price movement upwards, rather than the duration of the trend itself. Conversely, a "short" setup indicates a bearish projection.

Long Continuation Setup: Commonwealth Bank of Australia (ASX: CBA)

The chart of CBA from 18 June 2024 serves as a classic example of a long continuation setup, characterised by:

- A rising long-term trend ribbon (dark green).

- A rising short-term trend ribbon (light green).

- A consistent pattern of rising peaks and troughs.

- A prevalence of demand-driven candles, marked by white bodies and downward shadows.

- A potent demand-side candle indicating significant buying activity.

CBA has consistently ranked as a featured stock within ChartWatch ASX Scans for potential long positions, recently being featured in its fifth setup from the 53 times CBA has been run as a Featured Uptrend.

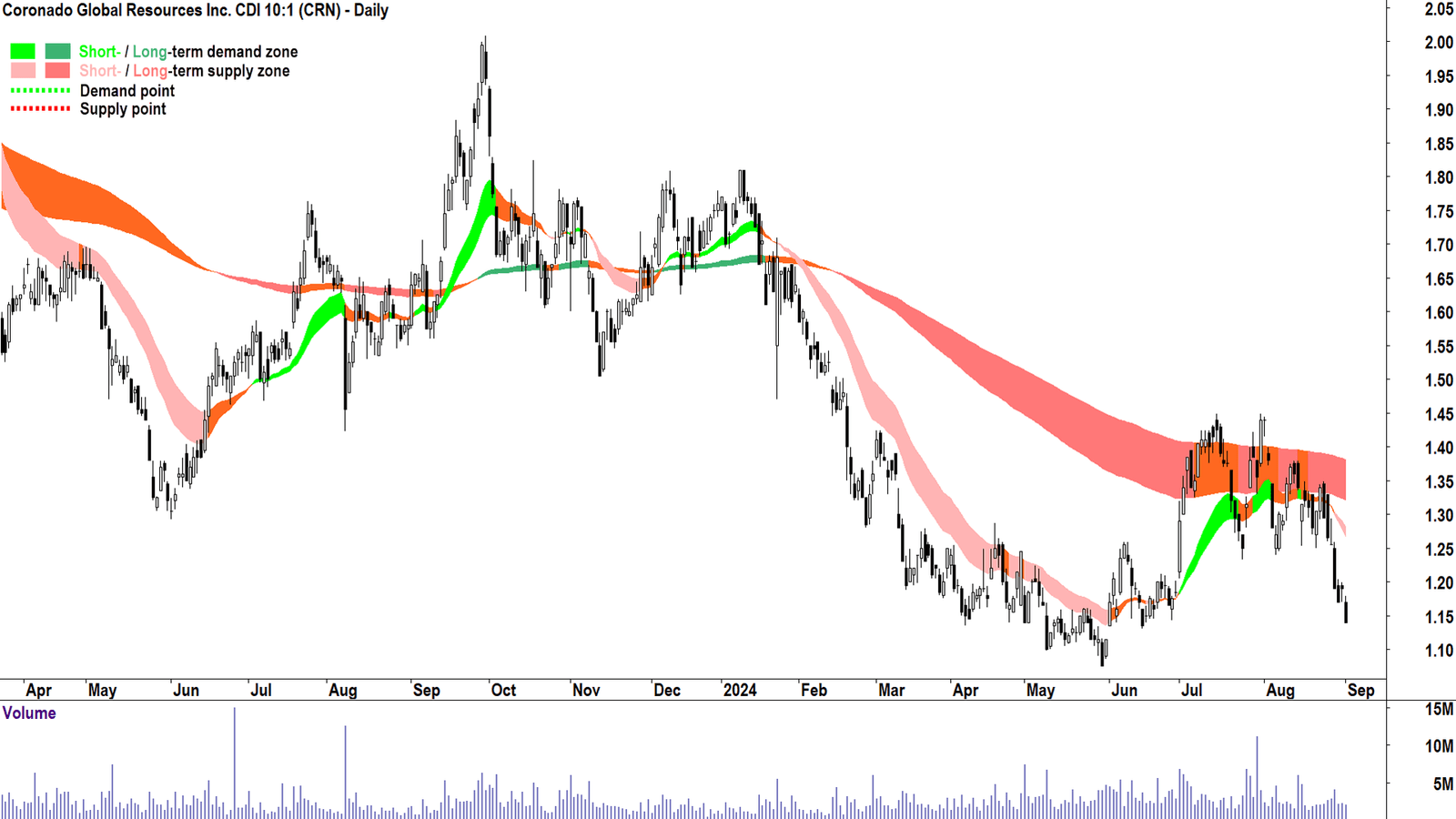

Short Continuation Setup: Coronado Global Resources (ASX: CRN)

Conversely, the chart for Coronado Global Resources from 3 September 2024 exemplifies a short continuation setup, showcasing:

- A falling long-term trend ribbon (dark pink).

- A falling short-term trend ribbon (light pink).

- A pattern of declining peaks and troughs indicative of supply pressure.

- A predominance of supply-side candles (black bodies and upward shadows).

- A strong supply-side candle, indicating heightened selling activity.

CRN has been featured for potential shorts, appearing in its fifth setup out of 62 iterations as a Featured Downtrend.

Advantages of Continuation Setups

Continuation setups are usually associated with lower-risk trading opportunities, aiming to capitalise on existing market trends. This methodology has significantly contributed to the opportunities presented in ChartWatch ASX Scans, as stocks often feature repeatedly during sustained trends.

Today’s Uptrends Scan List

This week’s scan reveals stocks exhibiting robust uptrends, suitable for investors looking for promising long positions. Here’s an overview of notable companies from today’s list:

| Company | Code | Last Price | 1 Month % | 1 Year % |

|---|---|---|---|---|

| Ainsworth Game Technology | AGI | $0.950 | -1.6% | -20.2% |

| AMA Group | AMA | $0.098 | +46.3% | +128.3% |

| Aspen Group | APZ | $3.45 | +9.2% | +104.1% |

| Bank of Queensland | BOQ | $7.79 | +4.0% | +33.4% |

| Brambles | BXB | $22.96 | +14.1% | +59.7% |

Highlighted Stocks from the Uptrends List 🚀📈

Among the top contenders displaying significant demand are:

- AMA Group (ASX: AMA)

- Bank of Queensland (ASX: BOQ)

- Dateline Resources (ASX: DTR)

- EML Payments (ASX: EML)

- Goodman Group (ASX: GMG)

Today’s Downtrends Scan List

Meanwhile, here are some noteworthy stocks exhibiting strong downward trends:

| Company | Code | Last Price | 1 Month % | 1 Year % |

|---|---|---|---|---|

| Avita Medical | AVH | $1.910 | -38.8% | -23.6% |

| Champion Iron | CIA | $4.25 | -7.8% | -42.6% |

| Collins Foods | CKF | $7.83 | -5.5% | -15.8% |

| Cettire | CTT | $0.415 | -10.8% | -82.6% |

| Elders | ELD | $6.20 | -0.8% | -25.2% |

Final Thoughts

As we conclude this birthday reflection, it’s crucial to note that stock trends are dynamic and subject to change. Ensure you conduct thorough research and apply this analytical framework judiciously.

Stay tuned for the final edition of Birthday Week, where we will delve into the turnaround setup and celebrate even more insights from ChartWatch ASX Scans!