CleanCore Solutions Shares Tumble Following Dogecoin-Focused Fundraising Announcement

Shares of CleanCore Solutions (ZONE) experienced a dramatic decline of nearly 60% on Tuesday after the company revealed plans for a substantial US$175 million (AU$266 million) private placement aimed at developing a digital asset treasury centred around Dogecoin.

The funding initiative involves the issuance of 175 million pre-funded warrants, priced at US$1 (AU$1.52) each. This move attracted interest from over 80 investors, including notable names like Pantera, GSR, and FalconX. The proceeds will be utilised to procure Dogecoin, with the aim of establishing the cryptocurrency as a "credible reserve asset" for transactions and tokenisation.

Pending regulatory approval, the placement is expected to close on September 4. CleanCore’s strategy involves not only purchasing Dogecoin for its reserves but also exploring opportunities for yield generation through staking activities on cryptocurrency exchanges.

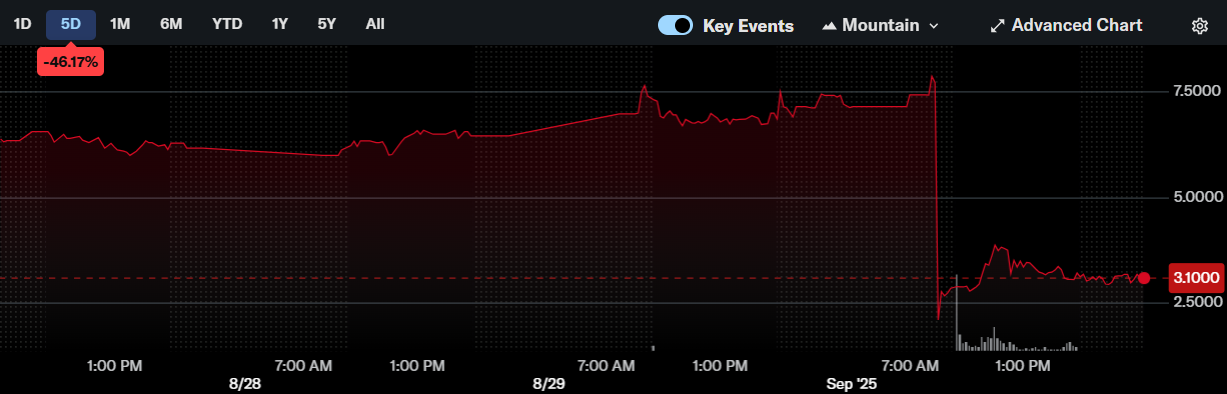

The market reacted sharply following the announcement, causing CleanCore’s stock to plummet from a previous close of US$6.86 (AU$10.45) to approximately US$2.69 (AU$4.09).

Source: Yahoo Finance

New Leadership with Crypto Ties

In conjunction with this strategic pivot, CleanCore has appointed Alex Spiro, a partner at Quinn Emanuel and a legal representative for Elon Musk, as the new board chairman. Additionally, Timothy Stebbing, who serves as director of the Dogecoin Foundation, has joined the board. The company also appointed Marco Margiotta, CEO of House of Doge, as the chief investment officer. House of Doge and digital asset manager 21Shares will provide advisory services on the treasury strategy.

21Shares notably leads the way in the cryptocurrency sector as the first entity to launch a Dogecoin Exchange Traded Product (ETP), which has the backing of the Dogecoin Foundation and is fully regulated under European financial regulations.

Currently, Dogecoin trades at around US$0.21 (AU$0.32), reflecting a modest increase of 7.5% over the past week, based on data from CoinGecko. Meanwhile, the Dogecoin blockchain, which operates on a proof-of-work (PoW) protocol, has become a focal point for Qubic, as the community voted to simulate a 51% attack to test its resilience.

This unexpected shift in strategy by CleanCore highlights the increasing integration of cryptocurrencies within traditional business frameworks, garnering both excitement and concern among investors and analysts alike.