Table of Contents

ASX Market Wrap – 18 June 2025

Market Overview

The S&P/ASX 200 index concluded the day down by 10.1 points, equating to a 0.12% decrease, driven primarily by declines in the iron ore and gold sectors. This drop occurred despite a relatively robust performance in other parts of the ASX, amid a backdrop of negative momentum in global equity markets due to rising geopolitical tensions in the Middle East.

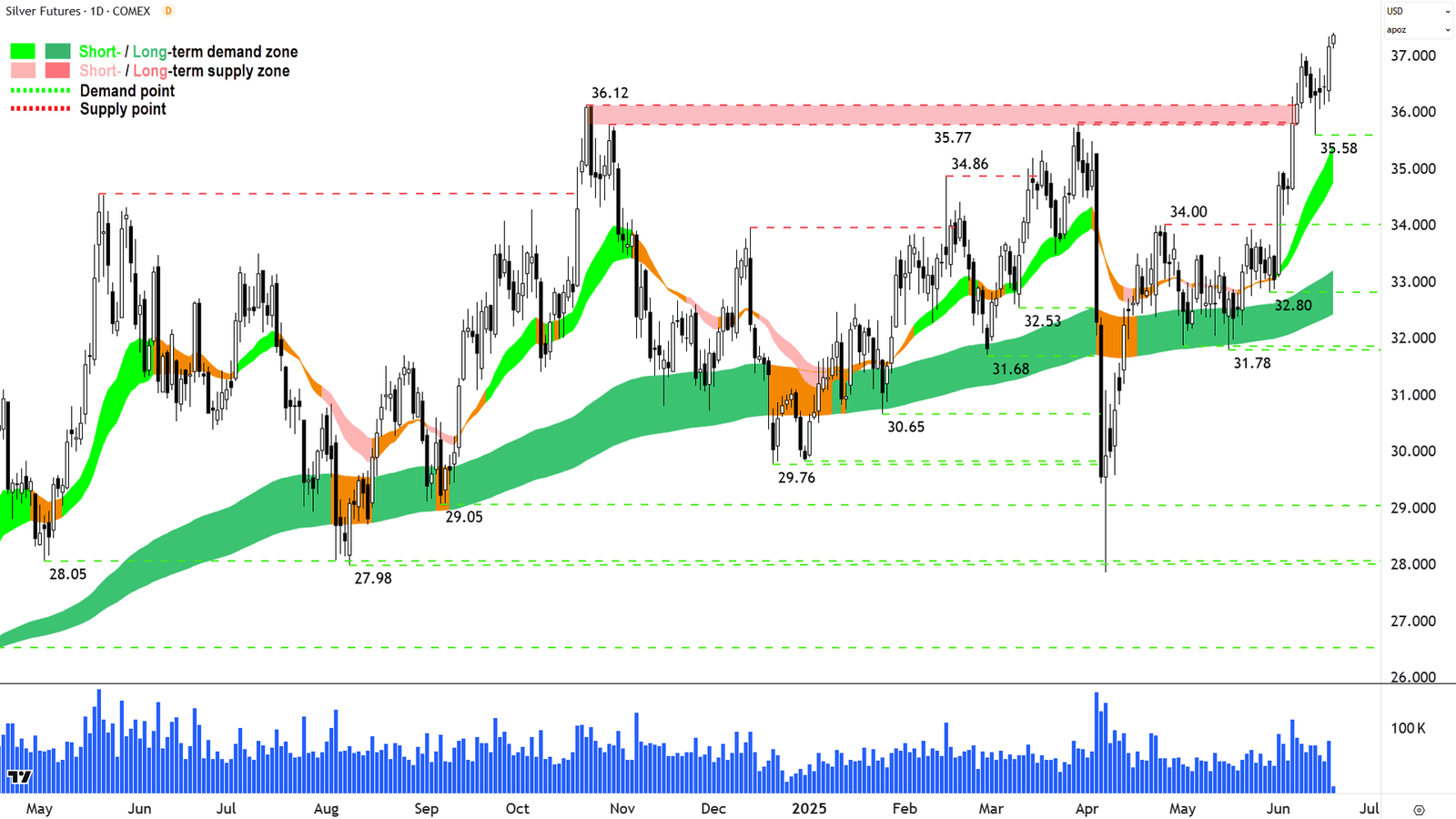

On a positive note, silver and uranium stocks delivered stronger performances driven by escalating commodity prices this week. Today’s focus will provide technical analysis across several major indices, including the Nasdaq Composite, S&P/ASX 200, and silver, as exhibited in our regular “ChartWatch” section.

Market Performance Summary

Major Indices

| Index | Value | % Change |

|---|---|---|

| ASX 200 | 8,531.2 | -0.12% |

| All Ords | 8,757.9 | -0.15% |

| Small Ords | 3,249.1 | -0.64% |

| All Tech | 4,038.5 | +0.62% |

| Emerging Companies | 2,275.8 | -1.15% |

Currency Exchange

| Currency | Value | % Change |

|---|---|---|

| AUD/USD | 0.6509 | +0.51% |

US Futures

| Index | Value | % Change |

|---|---|---|

| S&P 500 | 6,002.0 | +0.28% |

| Dow Jones | 42,330.0 | +0.24% |

| Nasdaq | 21,799.25 | +0.32% |

Sector Highlights

While material stocks faced challenges, the technology sector showed resilience, up by 1.09%. Other sectors such as health care (0.71%) and energy (0.65%) also reported gains, contrasting with materials which fell by 1.56%.

Technical Analysis Snapshot

The S&P/ASX 200 (XJO) experienced a minor decline, finishing at 8,531.2 amid broader signs of weakness, with decliners outnumbering advancers 162 to 112. Concerns in the iron ore sector intensified as major broker Citi cut its price targets amid dismal price trends.

Iron ore prices faced downward pressure, with significant declines noted, while gold continued to show volatility, leading to a 2.3% drop in the gold sub-index (XGD). This divergence highlights the complexities often seen in commodity stocks, where individual stock performance diverges from commodity trends.

Conversely, silver and uranium stocks gained traction, aligning with robust sectoral demand and chart patterns reported in the "ChartWatch". The silver market, in particular, is attracting interest due to its outlook, suggesting potential for a breakout.

Economic Indicators

The Australian MI Leading Index revealed a contraction of 0.1% for May, signifying a potential slowdown in economic activity. This aligns with Westpac’s forecast of moderate GDP growth at 1.7% by year-end, capped by observable weakening in economic indicators.

Upcoming Economic Events

- Wednesday: Building and Housing Permits data from the USA.

- Thursday: US Federal Open Market Committee’s Interest Rate Statement and economic projections; Australia’s employment change forecast.

- Friday: China’s Loan Prime Rate announcement.

Noteworthy Movers

Presenting Top Gainers:

- Archtis (AR9): +63.0% – Entry into the UK market.

- European Lithium (EUR): +45.5% – Secured funding for the Tanbreez Project.

Major Decliners:

- Antipa Minerals (AZY): -9.2% amid sector-wide weakness in gold.

- Catalyst Metals (CYL): -8.2% following drilling results.

Analyst Upgrades and Downgrades

- Cochlear (COH): Upgraded to ‘Buy’ from ‘Neutral’ at UBS, target at $325.

- CSL (CSL): Retained ‘Outperform’ at CLSA, target revised to $330.

Despite today’s challenges, the overall sentiment appears cautiously optimistic, particularly in sectors witnessing increased demand. As global economic pressures mount, market participants should remain agile and alert to shifts in sentiment and commodity pricing dynamics.