Table of Contents

Financial Overview: Key Developments in Central Banking and Cryptocurrency

In recent financial news, central banks are holding firm while adjusting their strategies amid evolving global economic conditions. The US Federal Reserve maintained interest rates, with Chair Jerome Powell indicating that more time is needed to evaluate the impact of tariffs on the economy. Conversely, the Bank of England held its rate at 4.25% but hinted at potential cuts in August as the job market shows signs of softening. In Europe, several nations, including Norway and Switzerland, have opted to lower their rates, with the Swiss National Bank reducing its rate to 0% and suggesting the possibility of negative rates if necessary.

The current global economic backdrop has kept markets on edge, with investors closely monitoring developments.

Bitcoin’s Market Performance

The cryptocurrency market continues to experience volatility, with Bitcoin (BTC) recently trading flat at approximately US$104,735 (AU$161,692), nearly unchanged from the previous week despite a brief spike earlier. Analysts suggest that the sluggish price action is influenced largely by long-term holders liquidating their assets for profit.

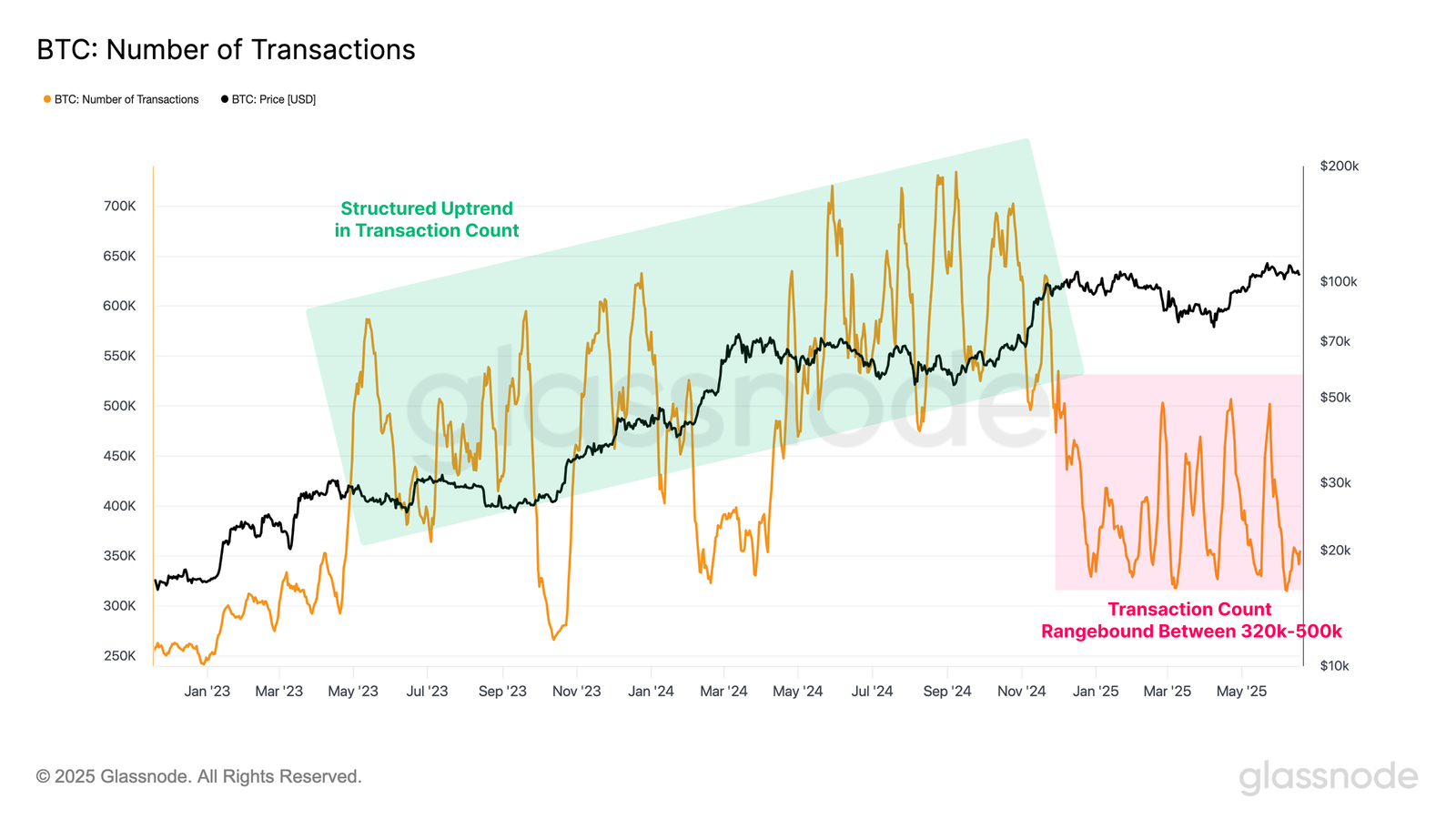

According to Glassnode analysts, the current landscape of Bitcoin trading resembles what they describe as an “on-chain ghost town.” The trading activity is increasingly characterised by large institutional players engaging in off-chain transactions, with total volumes in spot, futures, and options trading outpacing on-chain activity by a staggering 7 to 16 times.

Bitcoin transaction numbers, source: Glassnode

The Bear Market Debate

As some market analysts speculate whether we may be heading into a bear market, differing opinions abound. Swissblock analysts assert we could be entering the final phase of the current cycle, as liquidity appears to be diminishing. They are echoed by seasoned analyst Willy Woo, who suggests that while we may be in the latter stages of a bull market, significant movements are yet to occur.

Conversely, some industry observers, like developer Krissdev, argue that the market has not entered a true bull phase. They note a lack of capital flow towards altcoins, with many investors focused on recouping their investments rather than expanding them.

The prevailing sentiment among these analysts reflects a cautious outlook, especially for those who experienced losses during the last market downturn, when many were caught unprepared as the prices fell sharply after a euphoric rise.

Conclusion

As central banks across the globe adapt to shifting economic dynamics, the cryptocurrency market exhibits a perplexing blend of institutional interest and tepid retail activity. The ongoing debate about the market direction—whether towards a bear phase or merely a plateau—highlights the volatility and uncertainty that continues to characterise the financial landscape. Investors are advised to remain vigilant, weigh their options prudently, and consider both market sentiment and macroeconomic indicators when making decisions.