Table of Contents

The Expanding Landscape of Stablecoins

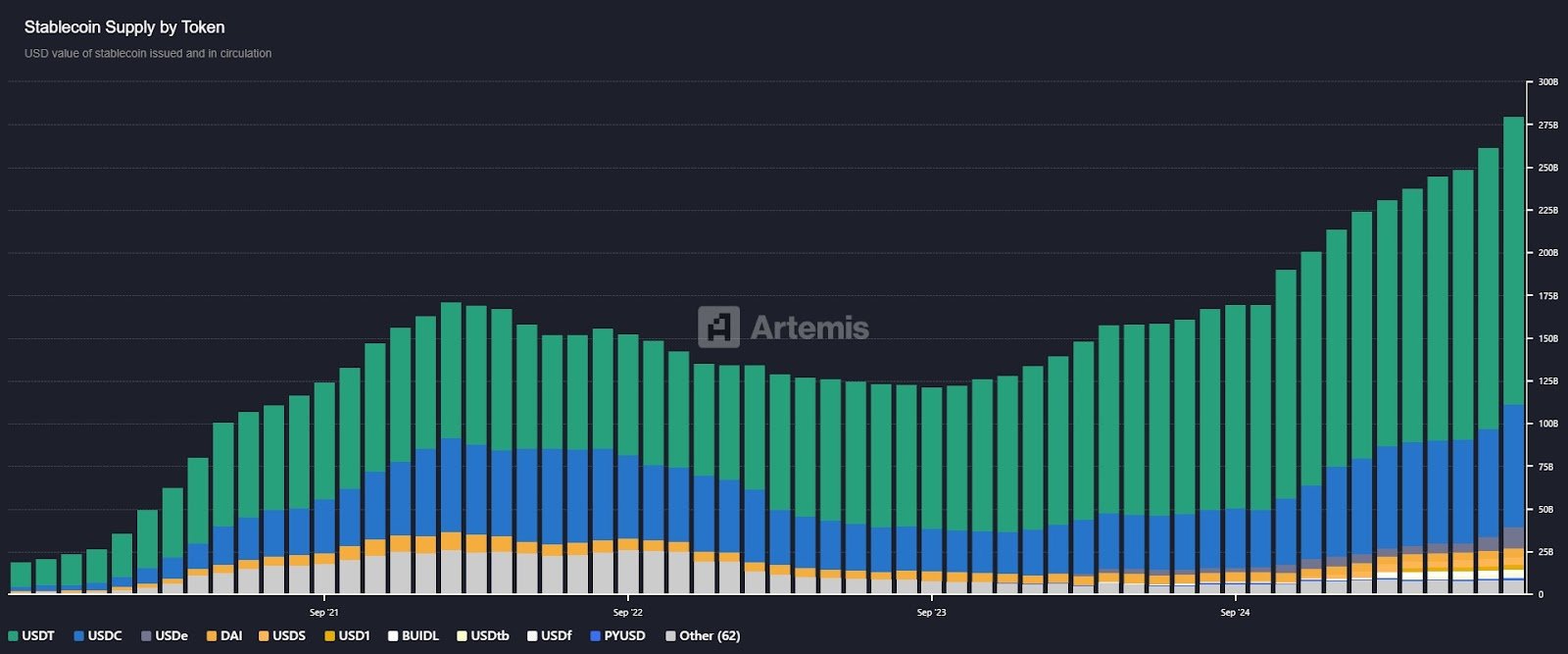

The stablecoin market has experienced significant growth, reaching a new peak of approximately US$280 billion (AU$426 billion) as of early 2023, according to data from DefiLlama. Analysts from McKinsey are optimistic about this trend, forecasting that the market could exceed US$400 billion (AU$609 billion) by the end of 2025 and potentially reach a staggering US$2 trillion (AU$3.04 trillion) by 2028. Initially designed for liquidity in cryptocurrency trading, stablecoins are now positioning themselves as serious competitors to traditional payment networks, offering advantages such as faster processing times, reduced costs, and global accessibility.

Ethereum continues to dominate the stablecoin landscape, with Dune Analytics revealing that 56.1% of all stablecoins operate on its network. As stablecoins increasingly replace conventional cross-border payment systems, more transaction fees are likely to flow into Ethereum’s ecosystem.

A significant catalyst for the stablecoin surge has been the implementation of the GENIUS Act, signed into law in July 2025. This legislation established the first federal regulatory framework for stablecoins, mandating a 1:1 reserve requirement held in cash or short-term treasuries, alongside public reserve disclosures. Importantly, the act also ensures that stablecoins are not classified as securities, which enhances their appeal to institutional investors.

Industry Reactions to Regulatory Changes

Following the enactment of the GENIUS Act, Tether wasted no time in strategising for its future, with plans to introduce a US-based institutional stablecoin. Tether’s CEO, Paolo Ardoino, has indicated that the company is actively preparing to enter the American market.

Meanwhile, Ethena’s USDe has made notable strides, tripling its market capitalisation since August 2024. In contrast, other players in the market have seen more modest growth, with USDC increasing by 87% and USDT growing by 39.5%, according to data from Artemis. Despite its rapid development, USDe commands a modest share, holding just over 4% of the market, while Tether and Circle maintain a firm grip, with 61% and 24% market shares, respectively.

Source: Artemis

In further advancements, Circle has partnered with Mastercard and Finastra to facilitate the settlement of USDC and EURC across various markets in Eastern Europe, the Middle East, and Africa. Additionally, Finastra has integrated USDC into its Global PAYplus system, signifying the growing influence of stablecoins in mainstream finance.

Conclusion

The rapid expansion of the stablecoin market indicates a significant shift in financial landscapes, supported by regulatory developments that encourage transparency and security. As traditional payment systems face competition from these new digital assets, the trajectory suggests a growing integration of stablecoins into everyday financial transactions, paving the way for the broader acceptance of cryptocurrency in various sectors. With continued advancements and partnerships, the future of stablecoins looks promising as they increasingly shape global finance.