Table of Contents

The Current State of the US Dollar

Since the onset of President Trump’s "Make America Great Again" (MAGA) initiative, a series of protectionist trade measures and tariffs have impacted the value of the US dollar. Notably, during his presidency, Trump voiced concerns over the strength of the dollar, believing it placed American exporters at a disadvantage. His administration signalled the possibility of intervening in the currency market and advocated for lower interest rates to temper the dollar’s ascent.

Currently, the US dollar is nearing its lowest point in nearly two years, with indications that it could potentially fall even further, a situation that could affect both the US and global economies significantly. As the world’s primary reserve currency, fluctuations in the dollar’s value impact international markets, commodities, and cryptocurrencies.

Dollar Dynamics: Key Influences

Several macroeconomic and geopolitical factors are contributing to the decline of the US dollar:

1. De-dollarisation

- Many nations, notably within the BRICS group, are reducing reliance on the US dollar for trade.

- Bilateral agreements between countries, such as China and Russia, are diluting the dollar’s dominance.

2. Trade Policies

- Trump’s trade tariffs risk weakening trade relationships, potentially undermining confidence in the dollar as a stable currency.

3. Economic Slowdown

- Recent indicators show a slowdown in consumer demand and a softening job market, negatively impacting investment in US-based assets.

4. Interest Rate Expectations

- With inflation coming under control, markets anticipate further interest rate cuts from the Federal Reserve, reducing the appeal of US assets to foreign investors.

5. Fiscal Deficits

- Skyrocketing US fiscal deficits raise concerns about the long-term viability of dollar strength.

6. Geopolitical Risks

- Global tensions and sanctions are prompting countries to hedge against currency risks by diversifying their reserves, shifting away from the dollar.

Implications of a Weaker US Dollar

A depreciating dollar does not operate independently; it reshapes market dynamics, particularly in commodities and cryptocurrencies.

Commodities on the Rise:

- Commodities are predominantly priced in US dollars; hence, when the dollar weakens, foreign buyers find it more affordable, increasing global demand and pushing prices up.

Precious Metals as Safe Havens:

- Gold and silver are traditionally viewed as hedges against fiat currency depreciation, attracting investors during dollar declines.

Base Metals Benefit:

- Industrial metals such as copper and nickel often gain in a weaker dollar environment, as it can stimulate global infrastructure investments by lowering import costs in emerging markets.

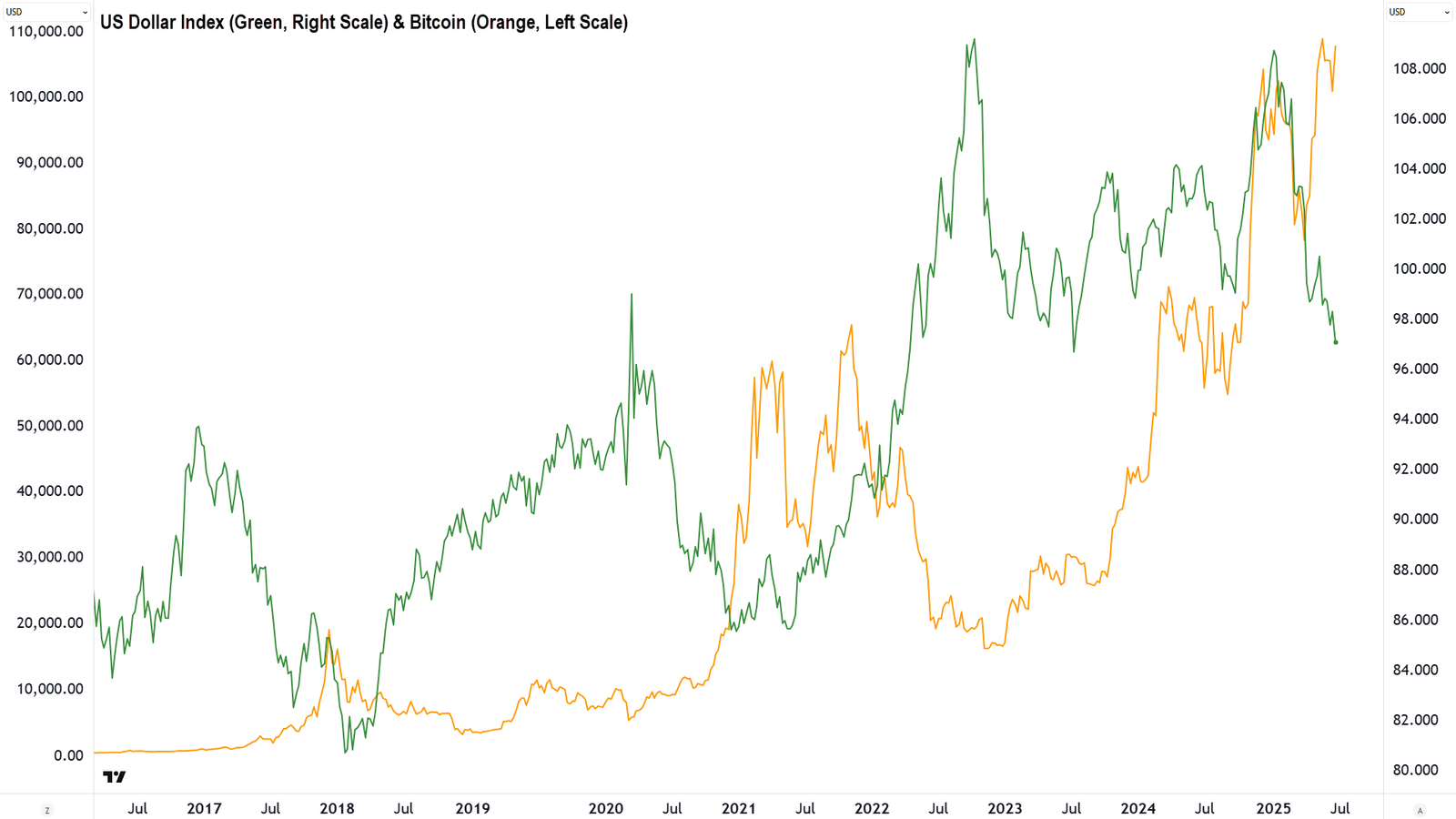

Bitcoin’s Appeal as ‘Digital Gold’:

- Bitcoin has gained traction as a hedge against inflation and currency devaluation, with previous dollar weaknesses correlating with its price increases, notably during 2020-2021.

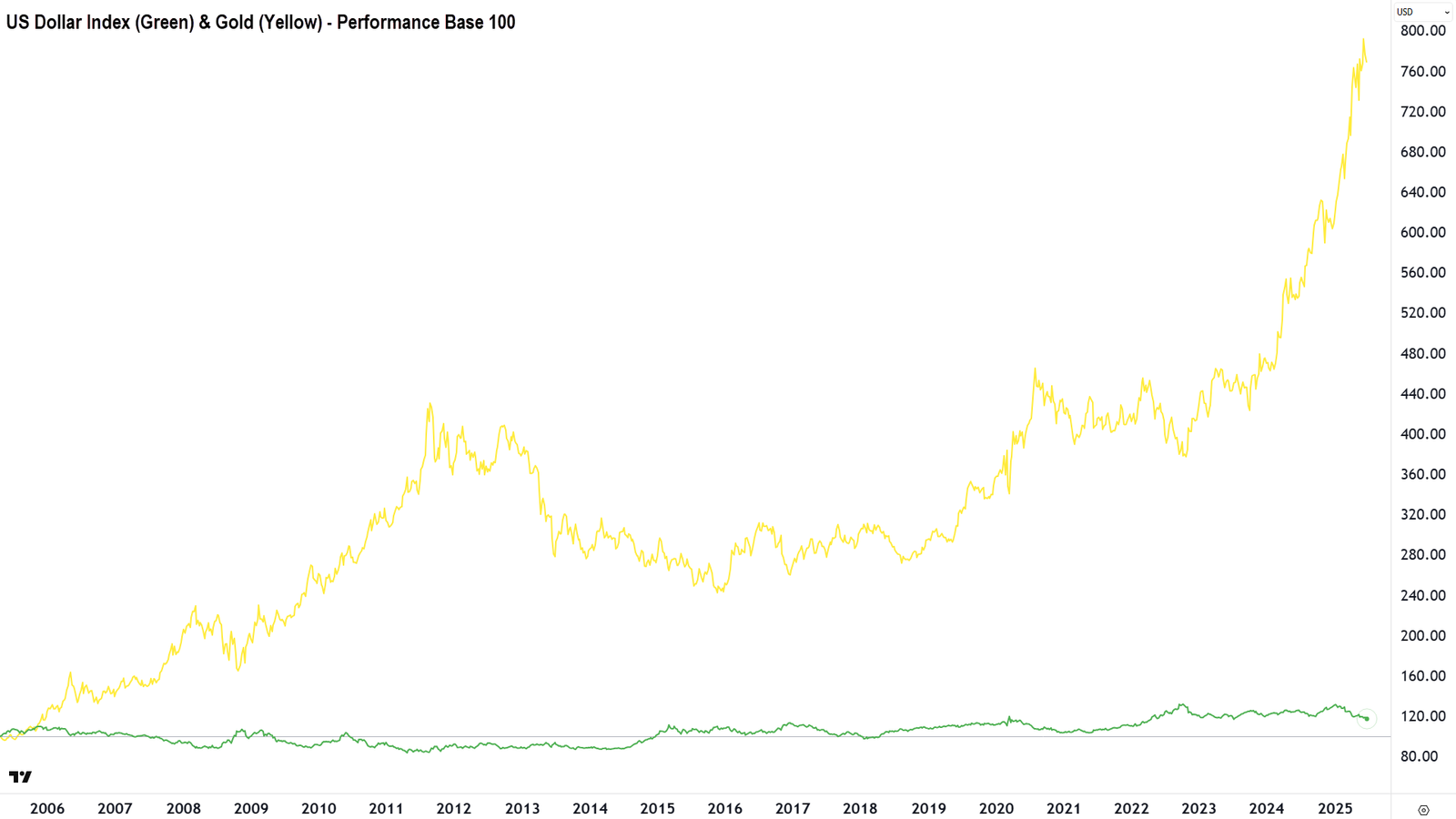

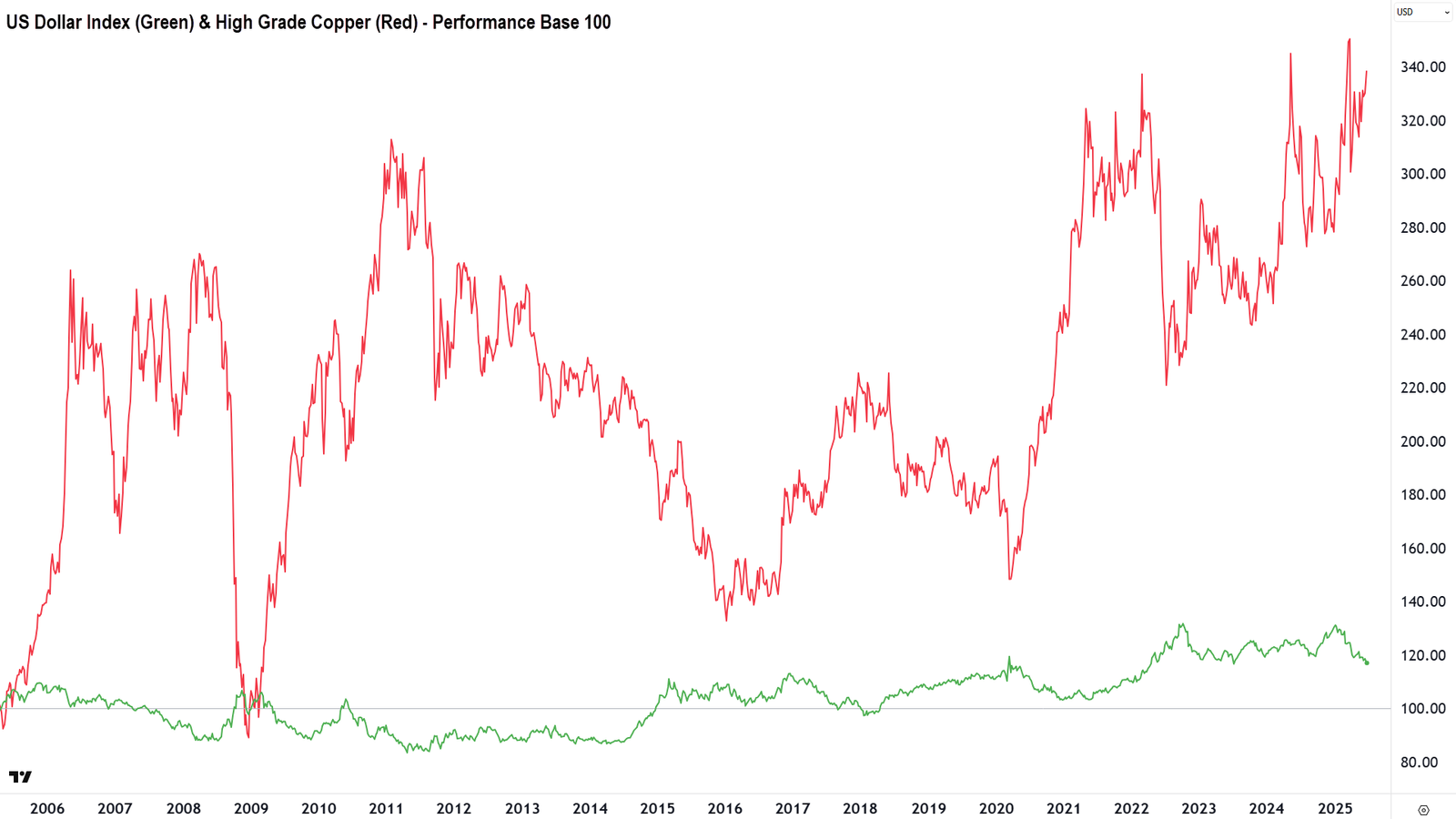

Historical Correlation: Dollar Performance Against Assets

An examination of historical data reveals patterns between the US dollar index (DXY) and other assets like gold, copper, and Bitcoin.

Data shows that:

- Gold: A moderately strong negative correlation (-0.49) suggests gold’s traditional role as a hedge against dollar weakening.

- Copper: A similar correlation (-0.37) indicates copper’s sensitivity to shifts in dollar value.

- Bitcoin: A much weaker correlation (-0.07) implies that Bitcoin’s price is less influenced by dollar fluctuations.

Conclusion: Monitoring the Dollar’s Path Forward

The outlook for the US dollar remains negative, with numerous entrenched macroeconomic trends suggesting further declines. If the dollar continues its downward trajectory, historical patterns indicate that hard assets like gold and copper could thrive, while Bitcoin’s response may be mixed.

Given the volatile landscape, unexpected shifts such as inflation spikes or geopolitical tensions could change the current trends. Investors should keep a close eye on data and trends moving forward, as understanding these dynamics will be crucial for navigating the evolving market landscape.