Table of Contents

Understanding the Current Financial Climate: A Perspective on Stock Markets and Interest Rates

In the world of finance, news can be a double-edged sword. Recent developments suggest a breather in the ongoing trade tensions between the United States and China, which previously threatened to trigger a global economic downturn. The resolution of these tensions has sent stock markets soaring, as investors react positively to the news. However, this commendable performance in equities comes with its own set of challenges for mortgage holders.

Market Reactions to Trade Developments

The easing of trade disputes has rejuvenated stock markets worldwide. In Australia, the S&P/ASX 200 Index has shown significant recovery, bouncing back from earlier losses incurred due to the trade war. Investors have welcomed the optimistic sentiment with a rally, driving stock prices closer to their pre-correction levels.

The Upside and Downside of Interest Rates

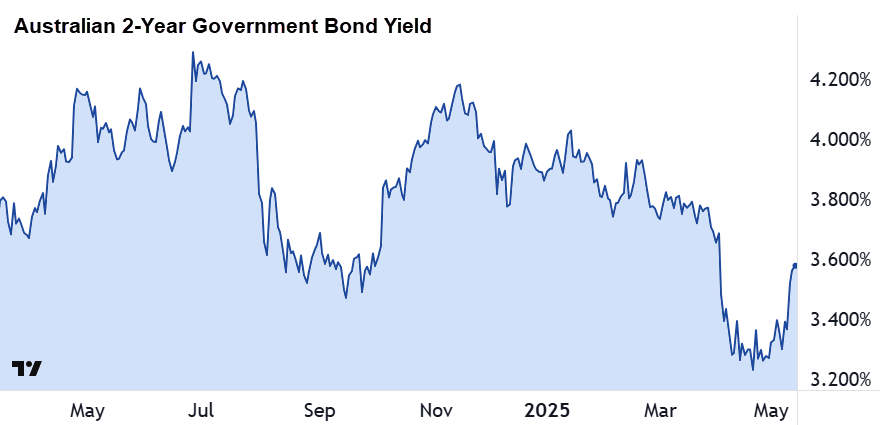

Typically, when fear grips global markets and stock prices drop, interest rates follow a downward trajectory as central banks seek to stimulate economic activity. This behaviour is largely predicated on the movement of bond prices, which rise amidst market uncertainty, resulting in lower yields. Consequently, this environment permits lenders to offer reduced mortgage rates.

Conversely, positive economic indicators lead to a sell-off in safe-haven bonds, causing yields to rise, which in turn significantly impacts mortgage rates. With stocks rebounding, interest rates may increase, creating potential challenges for homeowners.

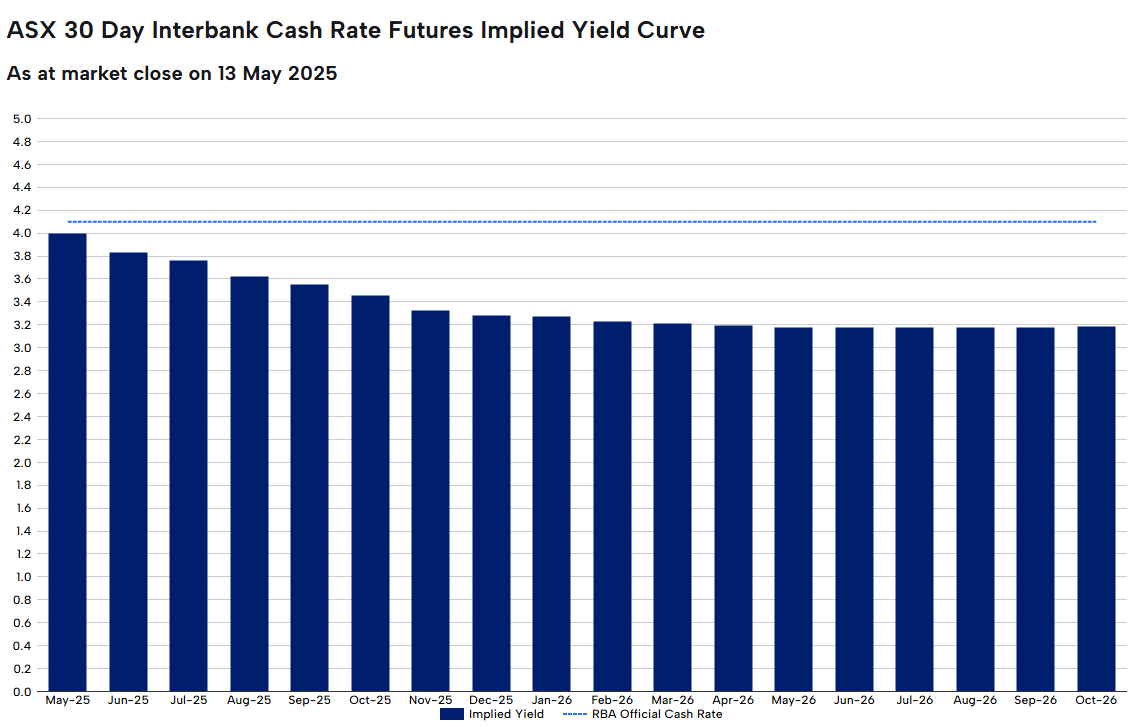

Insights from the Implied Yield Curve

The implied yield curve provides a valuable insight into anticipated changes in the Reserve Bank of Australia’s (RBA) cash rate over the next 18 months. The most recent data indicates that investors expect a reduction in the cash rate, with projections suggesting cuts could occur as early as June, with a substantial cut anticipated by August. Current rates stand at 4.10%, but projections trend towards a series of cuts totalling approximately 0.925% over the coming months.

Evaluating Recent Trends in the Yield Curve

Analysis of the yield curve’s historical data reveals a marked shift in investor sentiment due to changing economic conditions. Following significant trade-related downturns, the yield curve projected aggressive rate cuts. However, as news improved, expectations have softened, suggesting fewer cuts than previously forecasted. For instance, previous estimates anticipated up to five rate cuts, but many now position three as more likely.

Balancing Market Forces

In the intricate dance of financial markets, the relationship between stock prices and interest rates continues to evolve. While the recent stock market recovery is positive news for investors, it may pose challenges for mortgage holders if interest rates begin to rise. Yet, the overall economic landscape indicates a preference for fewer rate cuts, which aligns with the broader objective of avoiding recession.

In conclusion, while the prospect of increased mortgage repayments is a legitimate concern for borrowers, the encouraging stock market response could indicate a move towards stronger economic stability, which benefits both investors and the general populace. Monitoring the implied yield curve serves as a robust tool for anticipating interest rate adjustments and navigating these changing waters effectively.

As the situation develops, it is essential for stakeholders to stay informed and flexible, ready to adapt to the ongoing shifts in market dynamics.